Welcome New Readers!

Welcome new readers, my name is Steve! Whether you’re a long-term investor, just getting started, or somewhere in between, this is the place for you! My goal is to help you, no matter where you are in your life. It’s never too late to plan for your future, so join me in exploring the best tips and plans for you! I hope you find the resources that you’re looking for here. If you have any questions, or would like to chat, please fill out the form here.

Get the Latest News

We have a lot of fun here, even as we continuously improve our lives and become more wealthy. So you’ll want to follow along for FREE content.

You can get the articles by email using the box below.

Meet Steve

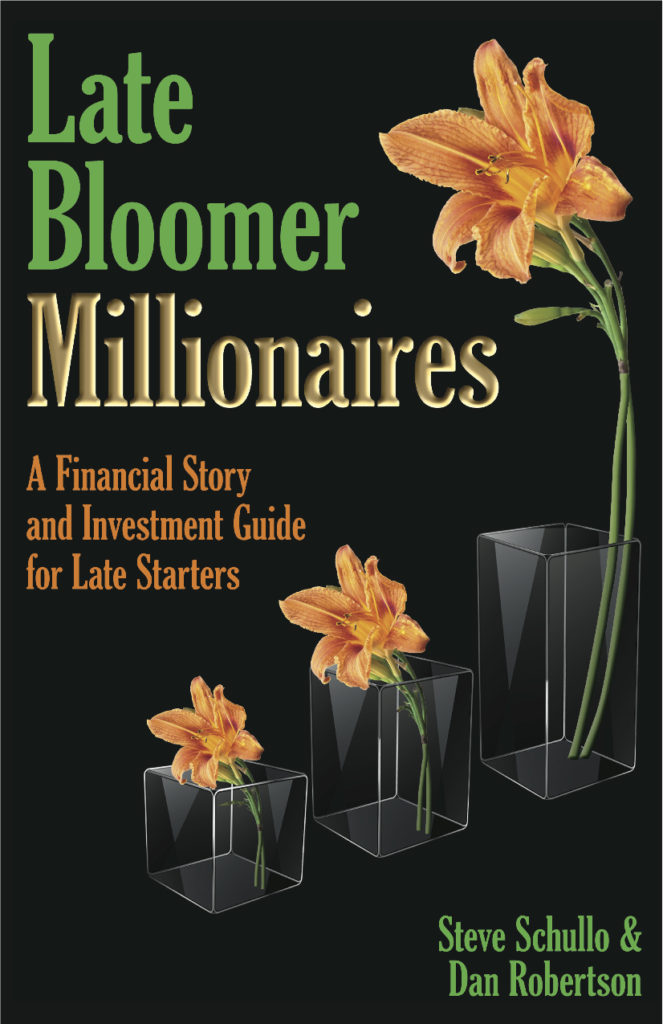

Steve Schullo is a retired Los Angeles Unified School District elementary teacher. Because of his negative experiences with financial professionals and their terrible and costly retirement products, he has been and is still a 403(b) reform advocate and author of two books. Steve is not a licensed financial or investment advisor, and the information and experiences shared as a do-it-yourself investor contained herein is for informational purposes only and does not constitute financial advice.

FREE PDF Download of My Book

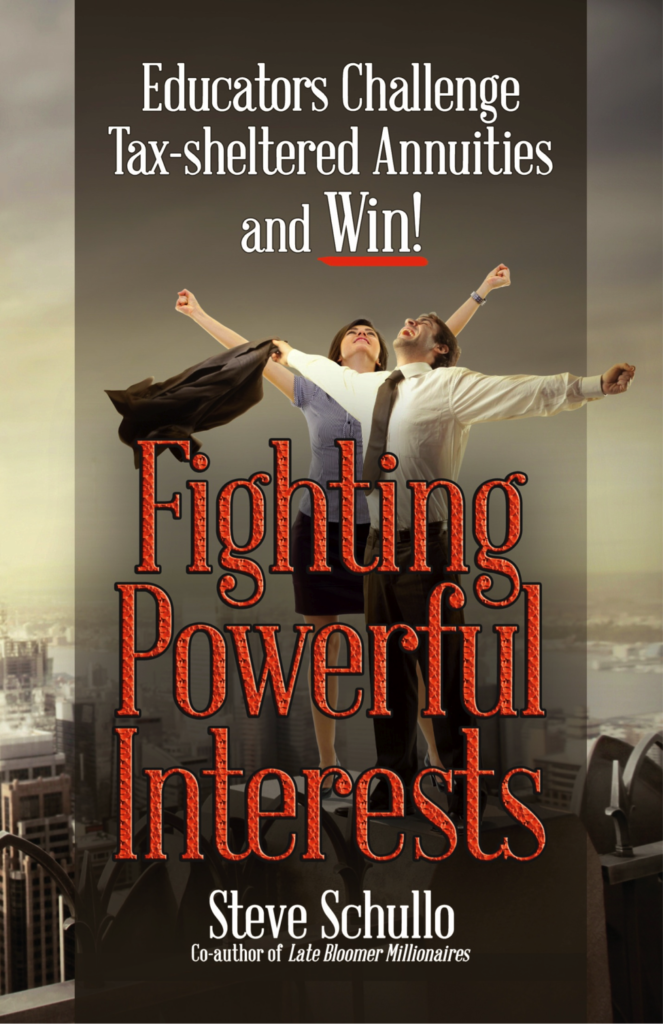

Steve is the author of an additional new book, released last year, “Fighting Powerful Interests: Educators Challenge Tax-sheltered Annuities and WIN!” A story of how a handful of LAUSD educators struggled for years to improve the 403(b) to no avail. But we never quit! We were instrumental in LAUSD’s implementation of the new 457(b) plan, and ended up with a “Plan Design” award.