Dedicated to Your Future.

Late Bloomer Wealth is dedicated to helping you ensure your financial future.

Resources to Get You Started

Credit Score Information

Most people want a great credit score. Is yours not good? Take heart, this Money Magazine article shows you how to improve your credit score with severaly easy steps.

- Sign up to post to our Discussion Board

- Listen (and subscribe) to our “Teach and Retire Rich” podcast

- Subscribe to our free BWISE ALERT eNewsletter

- Share your Teacher Story

- Have me speak at your school

- Become a 403(b)wise Super Advocate

- Contact us with ideas on we can reach and help even more teachers

Finally, the middle and senior high school teacher online and virtual training by Next Gen Personal Finance by Tim Ranzetta’s staff will be available during this epidemic shutdown. Below is the registration page.

Here are the workshops offered throughout the country until late August: https://www.ngpf.org/pd/fincamps/

https://investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletin-top-tips-selecting-financial

403bwise.org website and discussion forum were launched at the dawn of the 403(b) reform movement in 2000. There are several veteran educators that are knowledgeable about the specific problems challenging educators’ 403B/457b plans with PreK-12 school districts.

This is the world’s largest and most popular forum for independent investors. The Bogleheads follow a small number of simple investment principles that have been shown overtime to produce risk-adjusted returns far greater than those achieved by average (non-professional) investor.

Vanguard Group thanks the Bogleheads. learn more here.

Read their tribute to this outstanding group of smart men and women who are ready to help with anything in personal finance: investing, estate planning, budgeting, insurance, ETFs, books, movies and lots of videos of the Boglehead annual conference dubbed the “reunion.” John Bogle himself attends these special meetings. I have attended one and was very exciting chatting with Mr. Bogle.

Simple 3-Fund Portfolio:

We wrote about several model portfolios dubbed Lazy portfolio or “Couch Potato.” These are portfolios that are easy to understand, set up and maintain. The link above is a simple portfolio by financial author Allan Roth and his 3-fund Vanguard “lazy portfolio” eloquently titled “2nd Grader.”

TheSimpleDollar.com is a tool to help you manage your debt to gain financial independence. This comprehensive tool will help you develop your personal debt payoff plan as well as strategies and techniques to accelerate debt payoff.

https://www.modestmoney.com/top-finance-blogs/

The Powerful Magic of Paying Yourself First is one of the best strategies I learned way back to build wealth: http://www.thesimpledollar.com/the-magic-math-of-paying-yourself-first/?utm_source=feedly&utm_medium=webfeeds&utm_campaign=can-we-say-abracadabra-on-this-wednesday

A blogger who has a similar balanced portfolio that the Late Bloomer Wealth has: https://www.caniretireyet.com/my-investment-portfolio-full-disclosure/

A fantastic collection of everything related to personal finance.

Categories:

Budgeting

Building Wealth

Debt

Early Retirement

Frugality

Home Ownership

Hustling

Investing

Kick-ass Ideas

Making Money

Millionaire Money

Minimalism

Most Popular

Not Awesome

Retirement

Saving Money

Something To Think About

http://finviz.com/

A place to research where the market is currently for blog posts.

PBS Frontline “The Retirement Gamble” nationally aired on April 23, 2013.

Written Transcript about the problems with current savings into high-priced 401(k) plans and the lack of fiduciary standards.

The U.S. Securities and Exchange Commission has recently developed and released financial education materials for public school K12 teachers. The San Fransico office read the NY Times articles and began reaching out to teachers to help. On October 21st they made a presentation to the California Teachers Association retirement committee and my friend Sandy Keaton, the former retirement committee Chair loved them. Below are the links to their public documents.

For publications and information for all investors, please go to www.investor.gov

For information specific to teachers, please go to https://www.sec.gov/teachers

The Latest and Newest Announcement! Scroll down for FREE financial literacy workshops for you and your students–FREE

20-year-old 403bwise.org is now a nonprofit because of a huge supporter of financial literacy for K12 students!

I am so proud of my friends Dan Otter and Scott Dauenhauer. I have known them since the late 1990s. We have been trying to reform the terrible 403(b) with public k12 school districts for over 20 years! Read this tremendous development that might forever reform the 403(b), training teachers, and having financially savvy students ready for the adult world.

Los Angeles teachers might be familiar with Dan Otter. Almost 20 years ago Dan launched 403bwise.org. This site was the only site that offers objective 403(b) information and the discussion forum is dominated by savvy teachers (not insurance agents).

Nothing much has changed in the abysmal 403(b) world with public PreK-12 school districts, but the advocacy and the movement got a powerful influencer, Tim Ranzetta, co-founder of Next Gen Personal Finance.

Since 2014 Tim and his team have been offering 3-day financial workshops for free to k12 teachers all over the country. His workshops and a tremendous amount of resources are not only free, but he will pay for flights, hotel accommodations, and meals if you have to fly to one of his workshops, and he will fund a substitute for your class. I KID YOU NOT!

Tim’s passion is the teach financial literacy to all students across the country. But to do that, their teachers must be trained. So his primary purpose is to train teachers to teach their students financial literacy. When Tim read about Dan in the now-famous New York Times series on 403(b) articles published in 2016 (see below for those links), Tim hired Dan Otter to teach personal finance for the teachers. With the generous support of Tim, Dan and his friend Scott Dauenhauer recently relaunched 403bwise and it is now a 501(c)(3) non-profit organization. The new link is 403bwise.org. This came about due to the generous support of Tim Ranzetta.

The new site has many interactive features and provides numerous ways to get involved in the cause.

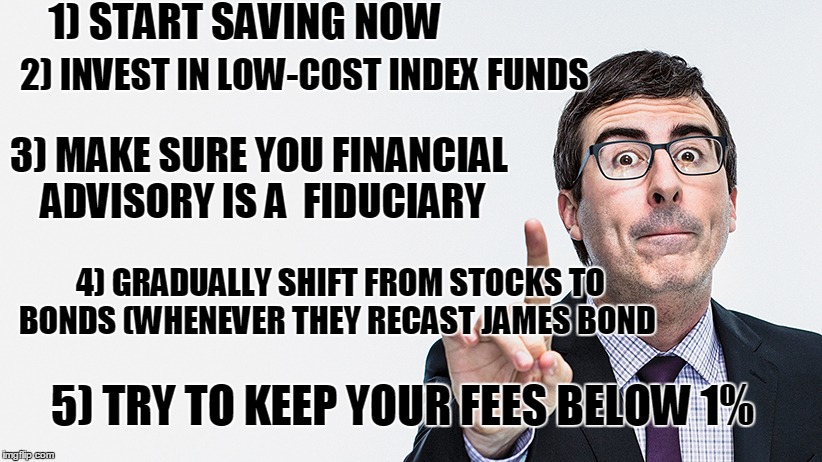

What does a little English humor mixed with personal finance produce? PLENTY! And You Will Discover This Financial Stuff is SIMPLE and will save you a bundle of money too.

Comedian John Oliver offers a humorous, valuable (and accurate) side to financial literacy for us regular investors and retirement savers. You will learn what a fiduciary financial advisor is and why, and be able to select a fiduciary, fee-only, advisor with confidence in a nanosecond (click on the picture to take you to his show. You have got to watch it!).

Test Your Financial Literacy

After Watching John Oliver’s brilliant presentation, test yourself and get a bonafide financial literacy score here.

Getting Your Questions Answered

VANGUARD GROUP

Vanguard Home Page: Visit Here

Vanguard Risk Tolerance Gauge: Read Here

The Bogle eBlog by John Bogle, the founder of the Vanguard Group. A huge collection of Mr. Bogle’s speeches throughout the years.

Back Testing Your Portfolio: Learn More

Choosing A Financial Adviser for Advice and to Manage your Portfolio is One of the Most Important Decisions You have to Make! I kid YOU NOT!

Fee-Only Financial Adviser with Fiduciary Standards (BUT, Always WATCH THEIR Assets Under Management, AUM costs. (AUM is in the form of a percent: .25%, .50%, .75% 1.0% or higher). IMO, 1.0% or higher is too expensive for your FA to manage your portfolio especially if you already own cookie cutter plans such as a managed balanced fund or a target date plan).

Read this article first before choosing a financial adviser here.

Refer to John Oliver’s show and his outstanding 20-minute segment about “advisers”, annuities and the financial industry at the top of this page: learn more.

The U.S. Securities and Exchange Commission has recently developed and released financial education materials for public school K12 teachers. The San Fransico office read the NY Times articles and began reaching out to teachers to help. On October 21st they made a presentation to the California Teachers Association retirement committee and my friend Sandy Keaton, the former retirement committee Chair loved them. Below are the links to their public documents.

For publications and information for all investors, please go to www.investor.gov

For information specific to teachers, please go to https://www.sec.gov/teachers

Are You Brave? From somebody who has been there: let’s begin a discussion with your significant other/spouse–About End of Life Financial Issues

The only thing I had to learn was to do the taxes and because I am technological literate, I taught myself Turbo Tax in one tax season. The number one problem for couples is that most likely the husband takes care of the finances and the wife is not interested. For those who are the financial heavyweight, you need to stress to your otherwise uninterested spouse that your life savings will be a risk to financial predators should something happen.

Here is an excellent article by American Association of Independent Investors on preparing for life’s inevitable: http://www.aaii.com/journal/article/life-after-a-loss-6-smart-steps-for-coping-with-widowhood?a=update072816

Attention Public School PreK-12 Educators

Below are EIGHT people who care about the best interests of educators. Why? Because it is the right thing to do.

#1 – Dan Otter is a teacher and LONG time crusader for better 403(b) plans and increased education among teachers about 403(b)’s. Dan has either been through or heard it all when it comes to 403(b) issues. As is the case with most teachers Dan was approached in his classroom early in his career by an insurance salesman pitching an expensive and inappropriate annuity-based retirement plan. Dan has a book and podcast on the topic of 403(b) and manages the forums at his website 403bWise.com where teachers share and discuss their experiences with 403(b) retirement plans. The media frequently cite him for his experience and knowledge about teacher retirements.

#2 – Andrew Hallam writes at AndrewHallam.com and is a former teacher and long-time student of investing. Andrew amassed over $1 million before the age of 40 and wrote a book about it. He continues to write about investing and retirement on his website.

#3 – Steve Schullo is the webmaster of this website, the author of two books and a retired Los Angeles Unified School District teacher who writes at LateBloomerWealth. Steve is frequently cited by media outlets for his experience and wisdom about the 403(b) situation facing teachers (high fees, low returns) and continues to be a staunch supporter of a better system for teacher retirement systems. Books: Late Bloomer Millionaire and Fighting Powerful Interests: Educators Challenge Tax-sheltered Annuities and WIN! (free pdf download from Steve’s blog).

#4 – Ed Mills is known as the “Millionaire Educator” and writes at MillionaireEducator.com. Ed and his wife have amassed nearly $1 million at the time of this post…on a teacher’s salary. Ed and his wife have used an amazing technique for saving and investing as well as taught overseas for a few years to amass enough money that they could put a huge portion of their salaries directly into their retirement accounts. They now regularly transfer school districts to roll their 403(b)’s into IRA’s with Vanguard (who I heartily endorse).

Read how teachers, Ed Mills and his wife, accumulated $1 million in 16 years! Yes, it can be done as public school teachers with one child. Click here.

#5 – Tony Isola is a former teacher and Certified Financial Planner (CFP) who writes at TonyIsola.com. Tony is a fired up advocate for teachers who is heated about the 403(b) options provided to most teachers. Tony knows both teaching and investing and provides a unique voice from someone working tirelessly on your behalf.

#6 – Dave Grant is also a Certified Financial Planner (CFP) who writes at FinanceforTeachers.com Dave is married to a teacher and shares a similar story about the 403(b) market available to teachers. Dave is a speaker and author as well as a trustworthy teacher advocate. Dave is experienced in dealing with a broad range of financial options for teachers and is available to come speak at schools in the Chicagoland area.

#7 – Scott Dauenhauer is another Certified Financial Planner (CFP) who writes his blog Teachers Advocate: http://teachersadvocate.blogspot.com/ He is one of the brains that created the best 403(b) in California under the guidance of the state’s teacher pension system: Pension2. He just released his 2nd book for financial advisors who want to work with k-12 public school teachers: Wild West: Providing Fiduciary Advice to Public School Employees

#8 – Ed LaFave early in my career as a software engineer I was taken advantage several times by financial institutions. Eventually, enough was enough and he learned how to invest on his own. I’ve been paying it forward by spreading that knowledge ever since. His wife works for OCPS (Florida teacher) and we went through the nightmare of setting up her 403b in March of 2017. We’re now committed to preventing OCPS employees from being victimized by that same process. https://educatorsfightingforfairness.wordpress.com/floridas-best-403b-457b-vendors/

For Older and Younger Adults already retired or planning for retirement.

Appropriately, the most popular blogs over the past six months were about retirement, among both the young adults looking ahead to it and the later baby boomers heading toward it.

Appropriately, the most popular blogs over the past six months were about retirement, among both the young adults looking ahead to it and the later baby boomers heading toward it.

Based on page view counts, here were the most-read blogs on Squared Away during the last six months of 2017:

Retirement Calculators: 3 Good Options

Why Many Retirees Choose Medigap

Reverse Mortgage: Yes or No?

Why Most Elderly Pay No Federal Tax

The 411 on Roth vs Regular 401ks

Medicare Advantage Shopping: 10 Rules

Good Reads for and about Old Folks

IRAs Fall Short of Original Goal

Before Retiring, Do this Homework

How Social Security Gets Fixed Matters

Old Savers Inch Ahead (The companion blog is GenX, Millennials Now is the Time)

Your Social Security: 35 Years of Work

Medicaid – it’s Not Just for Nursing Homes

The Securities and Exchange Commission has joined our movement to educator public PreK-12 educators.

They have offered a lot of resources to begin your financial education:

For publications and information for all investors, please go to www.investor.gov<http://www.investor.gov

For information specific to teachers, please go to https://www.sec.gov/teachers

Also, below are some of the links to the publically available materials we featured in our presentation.

Investor Bulletins 403b/457b:

https://investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletin-retirement-investing-through-0

Mutual Funds and Fees:

https://investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletin-mutual-fund-fees-expenses

Understanding Fees:

https://investor.gov/research-before-you-invest/research/understandingfees

How Fees affect your investment portfolio:

https://investor.gov/additional-resources/news-alerts/alerts-bulletinsupdated-investor-bulletin-how-fees-expenses-affect

Selecting a Financial Professional:

https://investor.gov/additional-resources/news-alerts/alerts-bulletins/investor-bulletin-top-tips-selecting-financial

Jill Persson

Securities Compliance Examiner

U.S. Securities and Exchange Commission San Francisco Regional Office

44 Montgomery Street, Suite 2800

San Francisco, CA 94104

Tel: 415.705.2474

BB: 415.518.0783