Hi everybody!

Every three months, the publicly traded companies release a report. These companies offer stocks for sale after approval by the Securities and Exchange Commission (SEC), and must report a detailed account of their balance sheet, earnings, profits (or losses), and other pertinent information. After all, individual investors, mutual funds, institutions such as foundations, pension plans, university endowments, and insurance companies are investors with a keen interest in these reports. The institution investors (not individuals such as myself) employ teams of brilliant analysts making a ton of money with powerful computers to go over these reports. Their goal is to consult with their bosses about selling, buying more stocks, or keeping them the same.

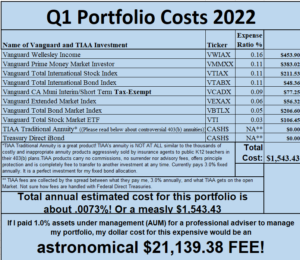

What I do here is replicate this process just to make sure my portfolio is doing what it is designed to do, follow the markets. I have a huge advantage in that I don’t care about individual companies’ quarterly reports, nor do I care about individual bond reports. All I care about are expenses, diversification, keeping my portfolio of all publicly-traded companies in my index funds are properly balanced between stocks and bonds, and rebalancing when needed (which is rare).

Thanks to the massive legacy of John Bogle and his Vanguard company, all I care about is staying invested in ALL the publicly traded companies from Bogle’s brilliant creation, the index fund. Vanguard has many index funds, but I invest most of my money in these three:

- Total Stock Market Index fund in 4070 U.S. domestic companies

- Total International Stock Market Index in 7754 companies worldwide

- Total Bond Market Index in 10127 different types of bonds.

The Three-Fund Portfolio is frequently used by the investing community. A book exists of the same name authored by Taylor Larimore of Bogleheads.org fame. Check the book.

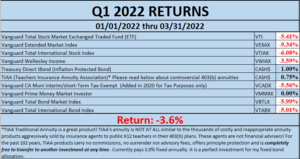

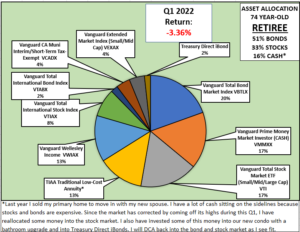

As you can see from my three graphs, my portfolio is down 3.6%. Because I invest in index funds, my entire portfolio follows the market like fans of their favorite rock group. I know why my portfolio is down, both stocks and bonds are down. Now isn’t that easy to understand? Just look at my table of returns.

I want to know what causes my money to increase, stay about the same or decrease in value. I knew an investor who lost money for two years when the market went up! She promptly fired her wealth management team, YEA A TEAM! And transferred her money to Vanguard. Since 2009, the market has gone up almost every year. It has been described as the longest bull market in history. If your money has not gone up since 2009, fire your adviser IMMEDIATELY.

Many blogs and investment websites explain in complicated and sophisticated language why the market declined. I don’t care! Yes, the following factors have an impact on my wife and me, but not on my portfolio construction or my plan: inflation is a factor (of course I care about inflation in my spending, but not my portfolio), or a terrible invasion by Russia, or the Federal Reserve Board has started to increase interest rates. Let me repeat as it is the core of my investing thinking, philosophy, and my emotions.

Allow me to elaborate. I was always amazed and thought about this famous Alcohol Anonymous Saying called the Serenity Prayer:

Ok, let’s break this worldwide famous prayer into three pieces and how each piece applies to investing:

- “Accept the things I cannot change” Interest rates, inflation, wars, my fellow investors’ terrible investment decisions, politics, governmental regulations, taxes, tariffs, trade restrictions, pandemics, environment etc. etc. You get the point.

- “The courage to change the things I can” This is getting interesting! Because it doesn’t take any courage to construct a diversified portfolio. I can only change by paying as little as possible how much I pay in investment costs (.07%), diversification (see pie chart), and the stock/bond split (33 stocks/67% fixed with bonds and cash because of my age). But the hard and courageous part is STAYING the COURSE! No matter what. You must think long-term and don’t get tempted into investing a ton of money in the latest gimmick such as cryptocurrency.

- “And the Wisdom to know the difference” The wisdom of investing takes time to develop. The things that I cannot change are all short-term, and the things I can change are long-term. Thinking for the long haul is the best antidote for your emotions. Only trust that the worldwide economies will grow over time and never trust any human being with your money.

Now that my portfolio is working as it should, I have the time to deal with real-life and the pandemic that we are finally coming out of. My wife and I still wear masks in public places and will continue to do so in 2022. We are improving our real estate investments and planning on traveling this summer. It’s been a difficult time for all of us these past two years. I have not written much here in my blog because of the major life changes I have had since my beloved Dan died 6.5 years ago. But good times have returned and I hope to share more of the good times as we come out of this terrible era.

Take care and stay safe,

Steve

Click on the images to increase the size

Steve’s Bio

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and UCLA Extension, retired in 2008. The first-generation Italian-American, ex-Marine, Vietnam veteran wrote investment articles for United Teachers-Los Angeles’ union newspaper (circ. 40,000) for 11 years. A thrice-featured volunteer retirement plan advocate, twice in the Los Angeles Times and once in U.S. News and World Report. Steve and his late husband, Dan were featured on the national broadcast PBS Frontline: The Retirement Gamble. He started an investor self-help group with Sandy Keaton for LAUSD colleagues and wrote 6,500 posts in three investment forums since 1997. Frequently quoted and interviewed by the media, testified at state legislative hearings, and honored with the “Unsung Hero” by the 40,000 member Los Angeles teachers’ union for his retirement investing advocacy.

After 15 years, Steve still serves on LAUSD’s Investment Advisory Committee as Member-at-Large and former co-chair. The committee oversees 457(b)/403(b) plans for 55,000 former and current LAUSD employees, with assets of $3.2 billion.