April 19th, 2021

Honorable Jackie Goldberg, Board of Education

Los Angeles Unified School District

333 South Beaudry Ave 24th Floor

Los Angeles, CA 90017

Dear Ms. Goldberg:

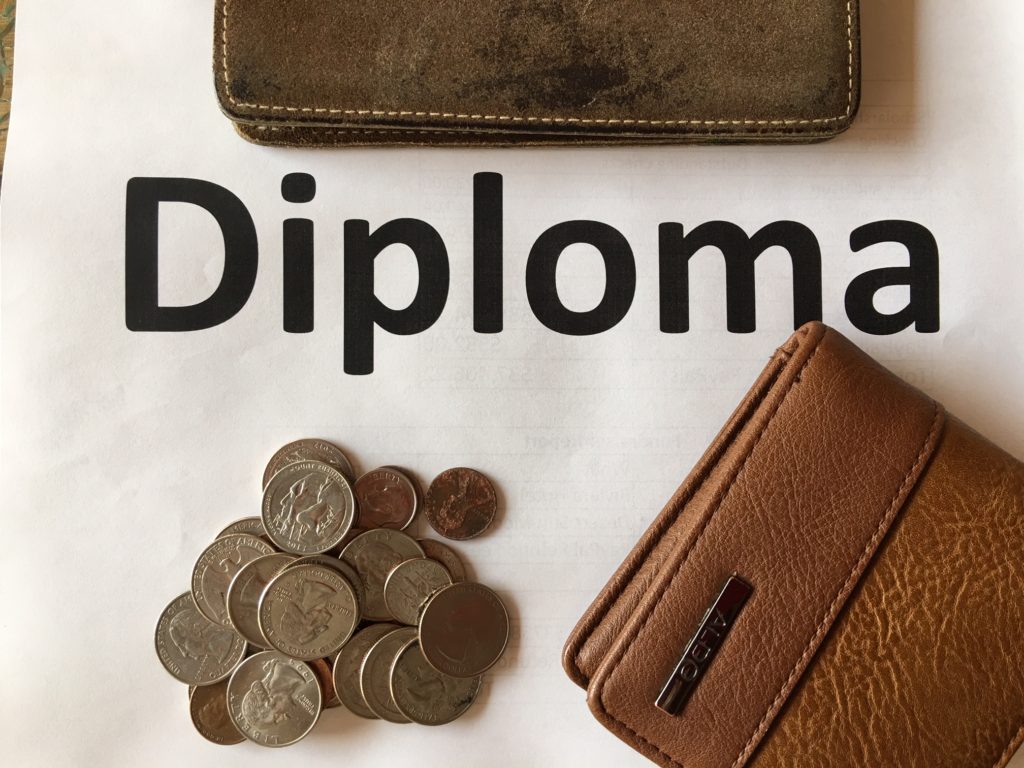

Did you know April is financial literacy month? This letter is about another progressive suggestion, pass a financial literacy resolution. With so much at stake, we must prepare our students for their futures. Financial literacy is also a social justice movement. Direct instruction is now possible at no cost to the district. Here’s how:

- I was thrilled when the Board passed your media literacy resolution. Dr. Jeff Share of UCLA is the go-to media literacy consultant, author, friend, and former colleague. There is an overlap of media literacy with financial literacy. Adding both literacies into the core curriculum will make the material interesting, motivating, and relevant. What else would a teacher and their students want from the classroom experience? And just as important, our students will learn the basics and skills to protect themselves.

- Since 2013 when he co-founded Next Gen Personal Finance (http://www.NGPF.org), Tim Ranzetta provided a financial literacy curriculum to more than 45,000 teachers who reached more than 2 million students. He and his 20 employees have offered professional development nationwide to 10,000 teachers, including over 130,000 hours of online PD since the pandemic struck in March of 2020.

- The curriculum is FREE, and PD is free. How? Tim has created an endowment to fund the non-profit, which has a goal of Mission 2030. All students will cross the graduation stage by that year, having taken a one-semester personal finance course.

- Only seven states guarantee that a student will take a personal finance course in high school. California is one of the laggards, with less than 1% taking a class before graduation. Because of LAUSD’s size, the Board could set an important example to the state and nation. Also, NGPF has a three-year grant program to support large districts by covering the cost of a personal finance specialist to support district educators.

- Financial and media literacies are the latest social justice and progressive issues. Our students will discover how to be leaders in our complicated 21st-century world by asking critical questions (not followers, who fell victim to the culture of materialism and debt, media misinformation, misleading sales, and divisive politics). Fake news, crushing personal debt, January 6 insurrection, and GameStop stock-buying mania were caused by media and financial illiteracy. Education about these powerful and destructive media and Wall Street’s perverted economic incentives is the antidote.

- Twice a year for years, UTLA Preretirement Issues Committee has presented financial literacy and investment workshops for employees. The Board should support this effort and LAUSD teachers who are already teaching financial literacy by taking up NGPF’s 3-year personal finance specialist offer.

- The stage is set. Our social, economic, and political systems have changed, and much of this change is positive. All the pieces are waiting for your leadership to pull it together. You and the Board should be commended for passing your media literacy resolution. Having both media and financial literacy will make a powerful statement that LAUSD is preparing its students for the 21st-century challenges.

Sincerely,

Stephen Schullo, Ph.D.

Dr. Schullo’s Bio–Retired LAUSD elementary teacher and technology coach who currently blogs, advocates for financial literacy, and writes books. For 15 years a volunteer member of LAUSD’s Award Winning 457(b) plan Retirement Investment Advisory Committee (RIAC). Since David Holmquist asked me to serve, I remain humbled and honored as a member of this rare committee with PreK12 districts. Our savvy committee of employee collective bargaining reps and district staff advises the CFO on the 403(b) and 457(b) totaling three billion in assets.

cc

all seven Board members and sixteen others including the Superintendent, senior staff, and others who are supporters of financial literacy taught in K12 schools.

Here is a response from LAUSD’s Director of Instruction:

Dr. Schullo,

On behalf of the Division of Instruction, we thank you for your email and your emphasis on and endorsement of financial literacy for our students. For the last two years, we have had an MOU with City National Bank, and we work with EverFi, an online financial literacy program. This program is offered to all of our high school students. EverFI also offers a middle school and an elementary program. In addition, we work with the California Council on Economic Education, and together we offered six financial education sessions in person, last year, and six virtual sessions this year, to hundreds of parents and students. We know this is just a beginning, and we will continue to explore ways to ensure our students are prepared for college and career, including education in personal finance.

Thank you,

Esther Soliman

CTE-Linked Learning Administrator

213-241-8754