Hi Everybody,

COVID! I am so sick and tired of COVID 19, Delta, and now Omicron. When does this crap stop?! Yeah, this hit us all hard as our lives have been turned around every which way.

I am so sorry I have not kept up with my communication with you. So here goes with a brief review of 2021, ending with how my portfolio performed.

2021 turned out to be almost as bad as 2020. With the release of the vaccine in the middle of December 2020, it looked like the new year and 2021 would be a significant change back to something we used to call “normal.” But instead, it started terribly with another unpredictable bombshell that has nothing to do with COVID. We all know what happened on January 6th and the attack on our democracy and ended 2021 with another variant of COVID. In between, I had my eighth surgery in my life. This surgery was a strange one, the strangest I have had since my surgery history started when I was 20 years old during the Vietnam War (three knee surgeries, removal of a varicose vein, repair of a bone in my ankle, removing a cancerous tumor, repair a hernia, and now repair a hole in my retina). Next will be cataracts!

This time I need to repair a hole in my retina. I remained in my street clothes and I was conscious during the entire procedure. But I could not see what the surgeon was doing! It was probably a good thing too. In order to repair the retina hole successfully, the surgeon punctured the eyeball in three places to go in and physically repair the hole. It took a little over half an hour but the hardest part was the recovery of keeping my head down for a week so the bubble in my eyeball that acted like a “cast” to keep the repair in place so it would heal properly.

Books on Audio

Since I could not read during my eye surgery recovery, I listened to books on tape for the first time! I listened to Mathew McConaughey’s Green Lights, a Book on Warren Buffett, a book on the Long Term Capital Management debacle, F. Scott Fitzgerald’s famous story, The Great Gatsby. I have tried to listen to Capitol by Carl Marx and it is so long-winded and all of those references to other work, it was extremely difficult to follow. Other books that I read were Black Swan and Educated: A Memoir, both excellent and highly recommended. Here is my Amazon review of Educated: A Memoir by Tara Westover: https://www.amazon.com/gp/customer-reviews/R2FTWW7QC6IQU/ref=cm_cr_arp_d_rvw_ttl?ie=UTF8&ASIN=B072BLVM83

Sold my house and got a Great Price!

I made a huge decision to sell my big house in Rancho Mirage. I got a great price because of the market! Everybody is moving to the desert because of what is going on with the economy and remote learning and working. People can work anywhere and they wanted to escape the big city into something smaller. Joshua Tree is popular. Now I have the problem of reinvesting the proceeds into a stock and bond market that is expensive. More on this later.

Yosemite National Park

Georgiana and I have been to Yosemite several times in the past. When some friends invited us because they had never been to that magnificent park, we said sure. It has been a long time. But I didn’t think I would be wowed again like I do every time I visit the Grand Canyon in Arizona. Yes, I was WOWED again! I highly recommend going even if you had been there before. I celebrated my 74th birthday and got four shirts.

Cape Cod

We managed to travel to Cape Cod to visit family. We had a difficult time deciding if we wanted to go even though we were double vaccinated at the time. Recall that during August there was a slight surge because people thought the vaccine would keep them safe. How wrong that was! We were careful during our entire time by having our own Airbnb.

2021 Portfolio Performance

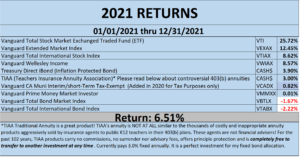

With a new President and his administration, the vaccines, and the economy opening up with the pandemic under realistic control, 2021 ended with my portfolio gaining 6.51%. I am not going to even attempt to explain how and why my very conservative portfolio gained another 6.51%. I am just happy it did.

As I have said before if the stock and bond markets go up my portfolio increases as well. In 2020, all of my bonds and stock index funds increase, but 2021 brought an additional challenge. For years the talking heads have been warning of a bond crash. Not only have interest rates increased but we had inflation for the first time in years. My bond holdings decreased in value and the reason why two of my bond investments, Vanguard Total Bond Market Index and Vanguard International Bond Market Index decreased by 2.27% and 1.22% respectively.

Why I never listen to the financial new media! And neither should you.

Do the talking heads, the so-called experts, really believe that a bond loss of 2% reflects a “bond crash?” A bear market is defined by a 20% or more decline and a correction is defined by a 10% loss. How is a crash in the bond market defined? Bonds are complicated. I have read two books on bonds and I highly recommend that you read up on how bonds work as individual securities and in a bond fund. How Treasury Direct inflation protection bonds work, and regular bonds. How choosing short-term, intermediate-term, or long-term bonds fit into your portfolio and why each term has unique returns. Long-term bonds return more than short or intermediate-term bonds but long-term bonds carry additional risk. I rather take risks in stocks, not bonds.

I am in no position to explain how bonds work so that you are competent enough to allocate a percent of your money in your balanced stock/bond portfolio. My portfolio shows which types of bonds I have invested in. Here are some basics I will share with you after years of investing in bonds for my fixed account allocation:

- Whenever possible, use highly rated bonds A, AA, or AAA-rated government bonds. Use corporate bonds in a diversified bond fund. I invest in Vanguard’s Total Bond Market Index along with government bonds.

- Most of my bonds are intermediate-term bonds (Short term bonds, Intermediate-term, and long-term bonds are available). But I use intermediate to offer some protection against rising interest rates.

- TIAA tradition annuity is a great fund for a portion of my fixed accounts. It currently pays 3.0% interest, with no costs, offers principle protection, and no surrender fees, so I can move it at any time with those hideous surrender costs charged by almost all other insurance companies. Yeah, I despise annuities for those high costs, but this fund acts more like a mutual fund than a costly, illiquid annuity sold to my K12 colleagues from the large insurance carriers for decades. But TIAA is only available to me because I had it in my 403(b) plan at my last employer, Los Angeles Unified School District. If you are a teacher, check your 403(b) plan. You might have it available too.

- Bond diversification is important too. Not all of my bond investments declined. My California muni, Treasury Direct iBond, and TIAA Tradition annuity all increased.

- The most important concept to know about bonds is that they reduce stock market risk. Bonds returns do not grow enough to beat the impact of inflation. While they can decrease in value as they did in my portfolio for 2021, they do not crash like stocks either.

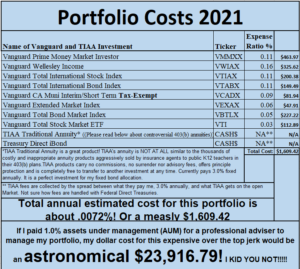

- I have all of my money in Vanguard and some in TIAA. Why? Because of a number of ethical reasons but the number one is LOW COSTS. The cost table below shows what I pay in percent and dollars and it is INCREDIBLY low.

A BORING Portfolio is Perfect for the Preservation and Distribution Phase

At the age of 74 and needing my investments to fund my retirement,

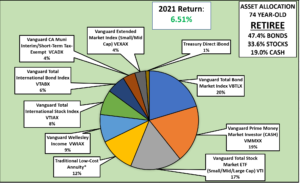

the pie chart below shows that I have 47.4% in bonds, 19.0% in cash, and only 33.6% in stocks. This explains why my portfolio only returned 6.51% when the total stock market returned 25.72%. Because I am done playing the wealth accumulation game, I am very happy I got that 6.51% in 2021 and a 9.34% in 2020. My financial plan is locked in the preservation and distribution stage because I am living off of my investments. This is what people do IN RETIREMENT!

If you are new to investing, notice that I have the Vanguard Wellesley fund. This fund is already balanced between stocks and bonds very similar to the stock-bond balance with my overall portfolio. It is a great fund to get your feet wet with Vanguard and investing. Here is a link to Vanguard’s Wellesley: Click here.

Below is my asset allocation in the pie chart (doesn’t it look beautiful?), annual 2021 returns for each investment and the overall portfolio return, and finally the costs of each investment and the total dollar cost I pay.

I hope you find this information helpful. Managing your portfolio is not as difficult as you might think.

Best of fortunes in 2022,

Steve

Steve’s BIO and Personal Finance Story

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) from 1984 to 2008 and UCLA Extension teaching educational technology to student teachers.

Why I started this Blog

I started this blog in 2012 to help all PreK-12 public school educators nationwide, especially my Los Angeles Unified School District colleagues. I belong to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b) and support the new and lower-cost 457(b) plan.

During the past 25 years, 40 newspaper 403(b) related articles have been published. Each one says the same: TSAs (Tax Sheltered Annuities) are terrible 403(b) plans. The only one who benefits is the salesperson with lucrative commissions and high-costs and other benefits such as complimentary trips to Tahiti, Hawaii, and other exotic places. Nobody in educational leadership or many teachers read these articles. And we don’t know why….

Action Plan: Our Advocacy is Growing

The following links are to get my free books and to get more information about stopping, getting out or transferring a high-cost plan to a low-cost plan.

It is also for those advocates who want to help colleagues with their 403(b)s. If you are helping yourself get straightened out of the annuity product and into a genuine and lower-cost investment, we are here to help with resources so you can help your colleagues too.

We come together at 403bwise.com and 403bwise Facebook page https://www.facebook.com/groups/349968819000560/ Come on over if you want to join us so we can help our colleagues avoid these self-conflicted and high-cost Tax-sheltered Annuities (TSAs).

I was so angry that I was taken advantage of that I authored of two books, Late Bloomer Millionaires and Fighting Powerful Interests: Educators Challenge Tax-sheltered Annuities and WIN!, a story of how a handful of LAUSD educators struggled for years to improve the 403(b). Fighting Powerful Interests is specifically written for LAUSD teachers! This book expands on my story with LAUSD, UTLA, and AFT where I was on the selection committee in 2002 when AFT was selecting a national 403(b) vendor. It is all there and its fascinating. You will learn the business of tax-deferred retirement plans with LAUSD and how to become a savvy investor to grow your volunteer supplemental retirement plan.

I have learned that most people want to do the right thing for all LAUSD employees, but powerful obstacles own interests block reform. Find out what they are by reading Fighting Powerful Interests, so together we can fix the 403(b) for future generations of teachers.

One definite answer to the high cost 403(b) is the non-biased and low-cost 457(b) plan. You will learn firsthand what is the 457(b) plan and why one insightful and compassionate benefits administrator brought it to LAUSD. He also asked my friends and I to serve on the volunteer advisory committee.

My LAUSD friends and I never quit! As mentioned before, we were instrumental in LAUSD’s implementation of the new 457(b) plan and earned an exceedingly rare, but very precious “Plan Design” award.

For a FREE copy of both books, email me at steve.schullo@latebloomerwealth.com and I will happily email you both books, FREE with no obligation except to read them and get informed, in a pdf file format.