Hi Friends,

It’s June and graduation time. I know a very bright high school graduate that will be attending college to major in finance. Since I know something about the industry through my extensive reading and as an ordinary investor, I wrote the following graduation message to him.

Hope you enjoy it,

Steve

Late Bloomer Wealth

Congratulations Graduate!

You heard the honors, tributes, and awards at your commencement ceremony with many futuristic words of wisdom from the dignitaries. I am excited about you majoring in finance and had a ton of fun writing my words of wisdom. But I only have one word, only one: FIDUCIARY.

Allow me to explain as a regular Vanguard investor. I paraphrase my succinct “words of wisdom” from what happened to another graduate in a namesake famous movie.

In 1968, fresh from the battlefields of Vietnam with my injuries still red and healing, I saw The Graduate. This movie is famous for many reasons, but I will focus on a couple. The film introduced a young Dustin Hoffman and reflected anti-authoritarian themes during the turbulent 1960s. The one-word advice at Hoffman’s graduation party changed the meaning of that word and provided a metaphor for my message.

The relative says to Huffman, “I just want to say one word to you, just one word.” “Are you listening?”

Hoffman says, “yes sir.”

“Plastics,” the relative said.

Hoffman asks what he meant, and the “wiser” adult says, “There is a great future in plastics. Will you think about it?”

Hoffman says yes, and the older relative says, “that’s a deal” and walks away.

My youthful 60s generation was already ridiculing the older generation as square, corrupt, greedy, warmongering, superficial, martini-sipping materialists on their way to the Hamptons. While he thought he was giving good advice to the graduate’s corporate-climbing future, the counterculture youth audience interpreted it as something to avoid.

I thought about this famous conversation as a perfect segue to what I want to say. Like plastics and its negative meanings, fiduciary has been practiced by professionals, except for the one career you are pursuing. A fiduciary is a legal term that means that you will look out for the clients’ best interests over your own.

Fiduciary responsibility was signed into law by President Roosevelt called The Investment Company Act (1940). Because of Wall Street’s shenanigans leading to the 1920s stock market bubble, crash and the Great Depression something had to be done to protect investors. That’s a long time ago, but few financial professionals practice genuine fiduciaries. In fact, like plastics’ cultural meaning, fiduciary is ridiculed and opposed. Wall Street and their heavily funded lobbyists in DC fight every proposed legislation that would require fiduciary responsibility by all financial advisers and stock brokers.

For the record, attorneys, Certified Public Accountants (CPA), and many pension trustees, practice fiduciary responsibility. For centuries MDs took the ancient Hippocratic Oath, but in the 20th century they recite an updated version of Hippocrates’ initial words “first, to do no harm.” Financial Brokers, Wall Street’s big financial firms, and the big “too big to fail” banks have successfully skirted fiduciary responsibility. In fact, no written or spoken oath, no ethical or principled requirement exists anywhere in the financial world, none, that look out for the client’s best interest! We all know how they did it: big money in Washington.

After a decade of introducing fiduciary proposed regulations and successfully beating it back, the financial industry responded by finding a clever way to say it to potential clients but nothing in writing. Heck, with that kind of freedom, everybody now calls themselves a fiduciary. It seems to be the new in-word for sales pitches and conflicts of interest. At the same time, they claim with utter silliness that they don’t make enough money charging by the hour like all other professions, plumbers, electricians, attorneys, etc.

My attorney charged $450 per hour to set up my trust. My tax man charges $595.00 to file my taxes every year. An electrician charged $150 per hour. What’s wrong with the hourly or the pay-by-project? Many investors only want what they need, not anything more. Paying by the hour would comply with current fiduciary mandates, but the financial advice industry does not accept hourly pay. Friends have reported that so-called “fiduciary” financial advisers say they charge an hourly fee but will not accept hourly pay! Several years ago, I wrote a blog piece when I confronted one of these supposed fiduciary advisers.

https://latebloomerwealth.com/2014/09/12/did-garrett-planning-network-pass-the-smell-test/

Because of clients growing financial literacy, and the demand for advisors to look after their best interests instead of the adviser, the financial industry eliminated commissions. Thanks to the impact of legendary investor John Bogle of Vanguard most investors know that commissions obviously lookout for the adviser’s interest first. So it’s easier for clients to find a fiduciary violation.

The Assets Under Management (AUM) model replaced commissions, but AUM is more sinister. Advisers and brokers can make more money over many years than a one-time commission. It appears to comply with the current fiduciary halfhearted legal mandate. But the AUM is too costly, any cost over .75% is too expensive for what you get, especially if the client has index funds that don’t need ongoing management.

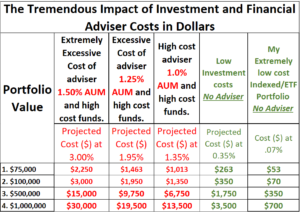

Investors are responsible for this terrible situation too. The profession reports those clients watch the clock and hate to write a check. Writing a check for financial advice is painful considering all the other bills we are responsible for, and clients walk away. For years the financial industry never employed this business model. So, the AUM is a perfect replacement for that old business model by eliminating that pain–fees are deducted from your assets automatically and hidden. If they are aware of the 1.0% AUM, which most are not because it is probably in the fine print, clients think about the current expenditure and not the long term. Once again, investors don’t know what they don’t know as I will show you in the table I created below:

With the AUM model, the industry can use our money as a temporary savings account and sap 1.0% to 1.5% per year. 1.0% AUM doesn’t seem like a lot. My table illustrates what the tiny 1.0% means in real dollars. I pay a minuscule .07% of my Vanguard portfolio. Look at the 1.35% difference between what I pay and what an outrageous 1.35% cost means in dollars! If I had an adviser managing my portfolio, I would be paying thousands more than the $1500 per year I pay.

So, my one-word advice turned into a full-flagged essay. Sorry about that. But this is what I do in retirement, write about the financial industry and how to protect ourselves. Thousands of books, articles, and podcasts in the blogosphere show brilliant finance articles. However, I know only a handful of professional financial advisers who eschew the AUM model and are genuine fiduciaries who charge by the hour.

I have a second word for you. Remember what I already mentioned, your future professors will see your talents and skills and recommend you to Wall Street’s big firm recruiters, but work for VANGUARD!

“Will you think about this?”

Congratulations Graduate and best of luck to you.

Steve

Steve’s BIO

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and UCLA Extension and retired in 2008. The first-generation, Italian-American, ex-Marine, and Vietnam veteran wrote investment articles for United Teachers-Los Angeles’ union newspaper (circ. 40,000) for 11 years. A thrice-featured volunteer retirement plan advocate, twice in the Los Angeles Times and once in U.S. News and World Report. Steve and his late husband, Dan were featured on the national broadcast PBS Frontline: The Retirement Gamble. He started an investor self-help group with Sandy Keaton for LAUSD colleagues and wrote 6,500 posts in three investment forums since 1997. Frequently quoted and interviewed by the media, testified at state legislative hearings, and was honored with the “Unsung Hero” by the 40,000 member Los Angeles teachers’ union for his retirement investing advocacy.

After 15 years, Steve still serves on LAUSD’s Investment Advisory Committee as Member-at-Large and former co-chair. The committee oversees 457(b)/403(b) plans for 55,000 former and current LAUSD employees, with assets of $3.2 billion. We update the 457b plan by lowering costs, implementing auto-enroll, and installing the Roth 457b. In 2014, our plan earned an Plan Design award f

He has self-published two personal finance books: Late Bloomer Millionaires and Fighting Powerful Interests.

Steve, as always you continue to serve.!

Cheers,

Ted

Sure glad you got home from the battlefields, bloody, but unbowed!

Steve, as always you continue to serve.!

Cheers,

Ted

Sure glad you got home from the battlefields, bloody, but unbowed!

I note your software sez I’ve said this before but I don’t think so. But then I celebrate #85 in Aug. so I never know.

Thanks Ted.

We go back a long way back to the early days of Vanguard Diehards on M*.

Thanks again,

Steve