Uncertainty and Market Crashes

Are the prices of my major holdings at pre-covid levels? Not yet but it is close. This post is about my thinking on this market crash today, June 10th, 2022

Since the pandemic started 2.5 years ago, I have had my ear to the so-called stock and bond market outlook on Bogleheads, 403bwise.org, financial professionals, Twitter, and investment forums such as Friends of Jack Bogle and Vanguard Facebook group, and the financial news talking heads. I have read and heard it all. Everybody has an OPINION about what caused this current downturn and whatever is happening at the moment will cause the market to increase, decrease or neutral. I find these comments typical of people who are desperate for certainty, and they know viewers want to know. All of them are searching for certainty. But to no avail. Our entire lives are uncertain so why would the investment world be any different. I had a healthy lifestyle with no smoking, a good diet, and exercising and yet I came down with stage 2 cancer at age 53! Out of nowhere, I was healthy one day and had cancer the next. Fortunately, my surgery to remove the tumor was 22 years ago and I am still fine now. But my point is no matter what we do as investors, our full diversified portfolios will decrease now and then. Books have been written about planning for the worse and sticking with your plan, whether investments, health, education, or marriage. Losses happen to us all the time in all areas of life and it hurts. Most spiritual leaders will preach that life is impermanence, especially Buddhist teachings.

CPI Report. Yeah, it’s bad but so what?

Investors were anticipating the CPI index report all week. This report showed that inflation hit a 40-year high at 8.6%. All the gloom and doom prognosticators are finally vindicated because they have been warning if the Feds didn’t print so much money in the last two years, we would not have inflation. I agree in principle only. Yeah, if the fed and congress did not do what they did to help shore up the economy and help people stay in their homes, instead of inflation we would have had a serious recession. I have seen that happen in the early 1980s. The Reagan administration created a recession to curtail the last bout of serious inflation of the 1970s. I remember somebody on the opposition party said that starting a recession is the easy way out. I remember getting laid off from my job in 1982. People are wondering if a recession is on the horizon? It sure looks like it, but my money management plan has all of it taken care of. But so much for politics.

University of Michigan Consumer Sentiment Survey: Yeah, it’s bad but so what?

There is an old saying from my elders growing up on a Wisconsin farm, “when it rains, it pours.” What also came out today was the famous University of Michigan Consumer Sentiment survey recorded is the lowest reading ever! I didn’t believe it until I went to their website and got the data. Sure enough, there it was: http://www.sca.isr.umich.edu/. I was thinking about 2008 and other crashes. But now extremely negative this sentiment shows just how people are feeling at the moment is the lowest ever about the economy and the future “ever.”

Warren Buffett has said repeatedly for decades is to invest when times and events are bad.

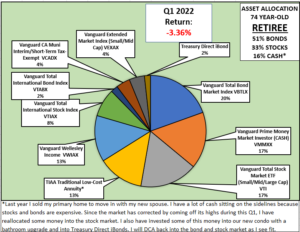

My point in this post is to ALWAYS ignore EVERYTHING that you cannot control. The skeptical part of me never takes the financial news seriously. I have had my portfolio, my “All Weather” portfolio in place for years. And the only activity I am going to do is allocate some of my Prime Money Market funds to Total Stock Market ETF, Total Vanguard Total International Stock Market index, and the Extended Market Index. These are all stock funds. This is a rare opportunity to re-allocate some of my house proceeds sitting in a no-growth MM account into stocks. I have waited since last summer when I sold my house until these funds’ prices dropped to almost pre-covid levels. They are not there yet.

June 10th, 2022 after a huge sell-off! Because the prices are now below PRE COVID levels at the start of 2020 stock market investment prices, looks like it’s time to invest in Wellesley, Total International Bond Index, Total Bond Market Index, and Total Internationa stock index. |

Pre COVID |

|

End of 2019 |

||

| Vanguard Wellesley® Income Admiral™ | $63.58 | $66.18 |

| Vanguard Total Intl Bd Idx Admiral™ | $19.74 | $22.62 |

| Vanguard Total Bond Market Index Adm | $9.89 | $11.05 |

| Vanguard Total International Stock Index Admiral | $29.09 | $29.87 |

| Vanguard Total Stock Market ETF | $195.43 | $163.62 |

| Vanguard Extended Market Index Admiral | $105.06 | $95.61 |

I will be dollar-cost averaging (DCA) some of my MM funds back into stocks if the market declines again on Monday.