Bloodbath? Maybe or Maybe Not.

Dear Readers,

What can I report? Just look at the sea of red. Needless to say, in the short term, the bond and the stock markets exposed my portfolio to a bloodbath! The usual events are that stocks decline and fixed income sometimes decreases or increases. Sometimes international stocks perform differently than domestic stocks, or the stock styles, growth and value stocks, or large cap, mid cap, or small cap perform differently. But not this year’s bear market cycle. What makes my portfolio a Bloodbath is that EVERYTHING declined double-digit, even Gold declined by 9.53%! Vanguard’s total bond market index declined an unheard-of 15%! People and the financial press either miss by accident or deliberately miss that Vanguard’s total bond market index rose in price to $11.53 cents a share, also a record (2020 during the flooding of the markets with Federal Reserve money). That high was achieved during the early part of COVID when the feds were buying up bonds and releasing trillions into the market.

Both Bonds and Stocks Declined!

When the market declines or increases, the unpredictability never ceases to amaze my fellow investors and me. I had never imagined that the ten-year treasury yield declining -15.68%!

Table 1 shows the major benchmarks, all in red. Since my portfolio was designed to follow the market, it did what I designed it to do. My negative -12.8% portfolio return was worse than the biggest stock market crash since the Great Depression in 2008. At that time, my portfolio declined by 11.9% for that year. Granted that the 2022 year has one more quarter before the annual returns for the history books will be written, but October has historically been a bad month for stocks. But I will not allow getting ahead of myself. Nobody can predict the future. We shall see how this last quarter fares.

Table 1

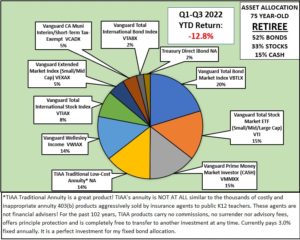

In the meantime, by reading the rest of my report, you should understand what I have done to protect myself when old man bear markets hit, and sometimes they hit hard and last longer than we like. Believe it or not, my portfolio (Pie Chart 1) was also designed to anticipate declines. This is the portfolio I constructed in about 2006, and the percentage allocations will be similar for the rest of this year, 2023, 2024, and so on. Pie Chart 1 tells my long-term investing story and what I have discovered to keep costs low with index funds, diversified among asset stock classes, bonds, and the crucial stock-bond split. The upper right corner of Pie Chart 1 is my appropriate stock bond split, 52% bonds, 33% stocks, and 15% cash. IMO most investors at my age take on way too much stock allocation risk and too little fixed accounts.

My Rationale for my conservative stock (33%) bond 67% split.

I have never used the popular 60%/40% stock-bond allocation. It’s a long story that goes back to when I constructed this portfolio. The bottom line is that I need my portfolio to assist my pension and social security to support my retirement lifestyle in expensive southern California. If I could live on my pension and social security without my portfolio, heck, I would have 100% in stocks and let my heirs and my chosen charities take care of their windfall. But that’s not my situation at all. I need my portfolio now, and another point I would like to make is that I have enough money to sustain myself for the rest of my days. I don’t have to play the investing game into overtime. I don’t have to take excessive stock market risk. I have already won in “regulation time” (using the four quarters and overtime in football as a metaphor), and the 33% invested in stocks is to keep my money somewhat close to the standard of living level (Yes, I know inflation this year will kill that notion but once again, I look at the long term).

Pie Chart 1

Table 2 below shows in detail how each investment performed. Yes, it looks horrible just looking at the table and seeing all of that double-digit red. But there are three reasons for me not to feel bad. First off, I know exactly why my portfolio declined 12.8% YTD in 2022. As mentioned earlier, the stock and bond market declined, and my portfolio was designed to follow the market! 2. Three investments did not decline: a. money market cash fund, b. TIAA Traditional Annuity and c. Treasury Direct ibonds and finally, 3. take a look at table 3 below.

Table 2

Psychology! And a Long Term Perspective Really Counts During Times like this.

It is always interesting because it is almost always psychologically calming to look at bad stock market times in perspective. In table 3, I listed the returns for my portfolio since 2006, when I first constructed it. YES! IT IS VERY SIMILAR all of these years, including 2022!

Since 2006, my portfolio declined only three times in complete calendar years (remember, 2022 is not over yet), and two of those declines are under 2.0%! My portfolio returns have INCREASED 13 times, and five times were double-digit gains! See how it is so easy to forget all our good years and only look at this terrible year?

Table 3

This is an excellent time to remind everyone, including me, to look at portfolio performance over the long haul.

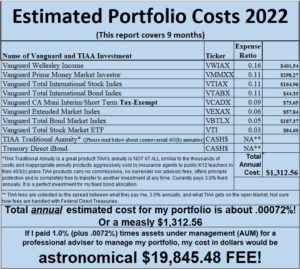

In the last table, I always report how proud I am to have the opportunity to invest in broadly diversified index funds with very low fees because there are no active manager costs and low turnover, so my capital gains taxes are low. This means more money in my pocket rather than going to an expensive financial adviser paying 50 basis points or higher. There isn’t enough return to pay for an adviser to manage a portfolio because, for decades, the stock market returns about 9-9.5%. By the time you pay for taxes and get hit with inflation, the 9.5% return is barely in the black. Assets Under Management are too high. If you need help to construct a portfolio as I have, hire a financial adviser that you pay out of pocket by the hour, just like all other professionals, attorneys, CPAs, your tax person, electrician, or your plumber. Last I heard, these professionals make a good living by charging an hourly fee.

Table 4

That’s it for this quarter. My intention is to provide a positive outlook during this trying stock and bond market times. Of course, I feel bad too, as my portfolio is down a couple of hundred thousand in dollars, but I am not sweating the details. I have ridden this horse before. Recall in the spring of 2020 when the markets decline into bear market territory but by the end of 2020, my portfolio had gained 9.34%!

I have lived a long life, and despite the investment mistakes I made over 20 years ago, I subsequently learned how to manage my money without help. As teachers, we tell our students that it’s OK to make mistakes, as you are going to make mistakes, but to learn from them. Adults can learn from mistakes just as well as our students. Learning from those mistakes decades ago has paid off tremendously during my retirement years.

Takeaways:

- In the short term, my portfolio is a bloodbath! But looking at the returns in the long term, it is doing what it was designed to do since 2006, make money.

- Another major point to make about my thinking and design of this portfolio is that it declined to only 12.8%. For example, a 100% stock allocation would have declined twice as much if invested in Vanguard’s Total Stock Market Index (-25%!). I cannot handle that level of volatility and loss at this late stage of my life. I simply do not have the lifetime years for my portfolio to recover.

- After constructing your diversified portfolio, stick with it.

- Think long term, always.

- Don’t forget the good times in the recent past when your portfolio made money.

- Learn from your mistakes, or better yet, learn from other people’s mistakes by reading their stories.

This is a good opportunity to read my story in my book Late Bloomer Millionaires as my late husband, Dan, and I, explain in detail the massive mistakes we made during the tech bubble and crash 22 years ago. You will benefit from how we learned and discovered to be seasoned investors. It was not like that at the beginning when we didn’t know much. But the learning curve was well worth the effort and time.

Best of fortunes,

Steve

Steve’s BIO

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and at UCLA Extension, teaching educational technology to student teachers. Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) union newspaper for 13 years. Thrice featured retirement plan advocate in the Los Angeles Times and U.S. News and World Report. He co-founded an investor self-help group 403bAware for teacher colleagues and wrote 7,500 posts in three investment forums since 1997. Frequently quoted by the media, he testified at California State legislative hearings and was honored with the “Unsung Hero” award by UTLA for his retirement planning advocacy.

For the last seventeen years, he serves as a volunteer on LAUSD’s Investment Advisory Committee as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s tax-deferred retirement plans, 457b/403b, of 55,000 former and current LAUSD employees, worth $3.1 billion in total assets.

He started this blog in 2012 to help all PreK-12 public school educators nationwide, especially his Los Angeles Unified School District colleagues. He belongs to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b). During the last 25 years, over 40 newspaper articles have been published and each one says the same thing, TSAs (Tax Sheltered Annuities) are terrible 403(b) plans. Over and over again, the articles report that the salesperson gets the benefit from lucrative commissions and high costs. Nobody in educational leadership reads these articles NOR talks about the proper place for annuity products publically. We come together at 403bwise.org. Come on over if you want to join us so we can help our colleagues avoid these self-conflicted retirement plans and TSAs.

For a copy of both books, click on my home page and scroll down to the two books. Click on each book and download it for FREE. No obligations as I am not a financial adviser.

Email Steve at steve.schullo@latebloomerwealth.com or ask your question after each post. Do not order from Amazon get it free from me.