Quarterly Report

by Steve

Many in the professional adviser community regard psychology as a significant factor in investing. I have two degrees in psychology and one in Educational Psychology. I loved my college majors. I discovered by accident that my college major played a significant and positive role in my development and discovery process to be a successful investor. I say “by accident” because I did not expect my psychological literacy to be a huge plus for investing success.

In this report, I will discuss the impact of psychology on the financial industry. If you look hard enough, you will see plenty of evidence displayed every trading day! Wall Street and the world’s stock and bond markets are huge psychological laboratories with millions of traders and professionals and their psychology. Wall Street comprises humans and their psychology, too. They are not immune to psychological effects either.

A great example is what has happened since October 2023. There is little doubt that Wall Street’s psychological perception and expectations increase or decrease stock market returns. Why has the market soared since last October through March 31st, 2024?

One significant event reported by the financial news daily was the expectation of lower interest rates. The DOW and the S&P 500 broke records because of the Wall Street mucky mucks’ perception that the Feds will lower interest rates starting last month, in March 2024. That was the expectation since last October 2023, and wow, did it move markets up! WAY UP!

But it can decrease returns, too. Since the end of the first quarter on March 31st, 2024, at this writing, noted in the middle of April 2024, a very different story is currently being played out. According to the Bureau of Labor Statistics, inflation was 3.2% in February. But it rose to 3.5% in March, which is higher than expected. The Feds didn’t lower interest rates in March as expected. So now the Wall Street mucky-mucks expectations have been pushed back to September. Furthermore, a few pessimists predict that lower interest rates may not happen this year!

So what happened? The markets went the other way, down. Since the end of Q1 reports on March 31st, the market has declined this past week from April 12th through 19th. Most of my 3.0% gain for the first quarter vanished. But I am not concerned, as this is a great example of how the psychology of expectations works for both positive and negative returns.

This is also called volatility! Get used to it. We cannot control it, but we can control how we react. Control the urge to DO SOMETHING! Instead, buy and hold, stay the course, as Jack Bogle has said repeatedly for decades, because it works! (Assuming you have a well-thought-out, diversified, and low-cost portfolio.)

This is precisely why I never listen to the news media. Of course, I have enjoyed the positive expectations since last fall and up to March 31st, 2024, when Q1 ended.

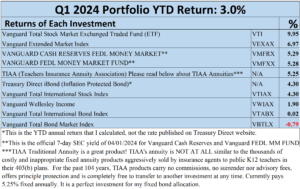

My Q1 2024 return is 3.0%, caused by Wall Street’s psychological expectations of lower inflation and interest rates. I’ll take it! Recall my 2023 annual report, my return was an astonishing 11.2% (my full report, click here).

Scroll down for the returns of all my investments ending March 31st, 2024.

Q1 Broad Market Returns

| DOW Jones Industrial Average (DJIA) | 5.62% |

| S&P 500 | 10.16% |

| NASDAQ | 9.11% |

| Treasury Bill Yield according to Treasury Department* | 4.20% |

The rest of 2024 will be interesting. The CPI data is released every month and is closely watched. Everyone is looking at inflation, as the Feds will not lower rates if inflation stays at current levels. The Feds’ goal is a 2.0% inflation rate, and they are nowhere near that goal yet. The inflation rate is 3.5% as of April 22, 2024. Unfortunately, inflation increased slightly in March above expectations, which sent the market down this month, April (The industry also mentions geopolitical risks associated with the Middle East and Ukraine wars and the nervousness of tech giants’ high valuations).

For the last decade, Wall Street has been so used to easy credit when it used to be normal that bond and savings account yields were between 4 and 5% for decades. This is nothing extraordinary if you know the history of interest rates. But Wall Street has been spoiled.

I look forward to my next report in July 2024 after Q2 is finished on June 30th for additional information on market volatility and how it relates to my portfolio return. When psychology is involved, the story continues.

Other News and Announcements

My favorite investment forum is the Bogleheads Investment Forum. They just announced that their annual conference will be in Minneapolis on September 27-29! I might attend this year and stay with my grandniece, husband, and three children. I informed them of this event, as they might be interested in attending.

I sent the Bogleheads leaders a suggestion for a different type of speaker. As you know, I am not impressed with the so-called “experts,” even though all of the experts follow the Boglehead way of investing, broad-based diversification with very low costs using the passive strategy with indices. So, I suggested inviting one or two non-professional Bogleheads to tell their stories of how they found the Boglehead way of investing, how it changed their investing life .

Every year, the John C. Bogle Center for Financial Literacy selects highly respected experts! I love them all, but I would like to hear stories from the regular Boglehead investors, too. I have done this many times as a presenter at my teacher’s union investment workshops and wrote a free book about it: Late Bloomer Millionaires.

Last year’s conference featured none other than two of my favorite authors and advocates, Tim Ranzetta of Next Gen Personal Finance and J.L. Collins, the world-famous author of The Simple Path to Wealth! The rest of the speakers are all of these highly respected professionals with lots of credentials, awards, and experience and are RESPECTED by the entire Boglehead community. But unlike the Morningstar “Long View” experts who are almost all in some form of active management, which is NOT the Boglehead investing strategy.

Books and Articles I read and Recommend

I have read many books. Most of the books are about personal finance, but I have read memoirs, some of the classics such as Moby Dick, and novels. My favorite novels are Little Big Man by Thomas Berger, Moby Dick, Anna Karenina, and Adrian by Hermann Hess, and my favorite memoir is by Meryl Streep’s You Again!

But almost all of the books I have read I loved because I learned something about investing, of course, but also myself, my culture, society, my country, and the world’s civilization. For American Culture, which I find most perplexing, especially during these divisive politics, I got a good perspective by reading this one NYT review of a 100-year-old book, Studies in Classic American Literature by D.H. Lawrence. Wow! I understand American culture from classic American literature of the 19th century from white dead men!

D.H. Lawrence is an English writer, and I like the perspectives of non-American writers and their perceptions. Of course, it is Mr. Lawrence’s opinion, but wow! His opinion explains, for me, the radical individualism sweeping the country. That was an eye-opener as I learned much about America, especially Americans, from this old English white male with insightful opinions of his day!

Micheal Lewis and Nissan Nicholas Taleb write my favorite finance books. Any book by Mr. Lewis and by Mr. Taleb. Mr. Lewis explains what we, as regular investors, need to know about the financial industry’s motives and incentives, its minions, and their closed culture, which is totally different from ours.

Mr. Taleb challenges our understanding of the world we perceive, as most of our perception is based on a reality that, once again, differs from our life experiences. Taleb verifies with data and common sense what many other financial authors have said, nobody can predict what the stock and bond market will do in the future. All of those forecasts that the talking heads in the financial media say with such useless confidence, they don’t know crapola. They continue to issue forecasts because that is what active public investors demand, and the forecasters keep providing it! Never listen, I don’t.

I totally ignore ANYTHING that the media says. So please don’t fall for that, as those unfortunate financially illiterate investors want to reduce the uncertainty. But it never goes away! I don’t fight it. I constructed my boring diversified portfolio 15 years ago, and I trust only one thing: that the world stock and bond markets will grow.

We must trust the markets will grow in the long haul because if we don’t, what is the point of investing? Trust the markets, NEVER people. Never trust what the professionals predict, no matter how many Ivy League degrees, awards, recognition, and that long list of credentials they earned. For an example of a professional with those credentials, listen to any Morningstar podcast, the Long View. A few are good, but I find most of them hilarious! Morningstar only selects those top-notch professionals with that long list of achievements. They don’t know shit about the future!

If you read one of my favorite books, Black Swan by Taleb, and poke around all the discussion threads at the Boglehead Forum, you will be convinced.

Steve’s BIO and Personal Finance Story

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) from 1984 to 2008, and UCLA Extension taught educational technology to student teachers.

A Brief History of the Horrific 403(b) with Public K12 School Districts

When I was a young teacher, I started saving for retirement. I bought two Tax Sheltered Annuities. We educators immediately recognize the brand name TSAs. Later, when I learned that annuities were not an appropriate plan for building a long-term retirement nest egg, I discovered mutual funds were available. The first question I asked was, “Why didn’t anybody in the district tell me this?” Worse yet, they refused when I asked the district benefit administrator for a printed list of available low-cost mutual funds (called no-load) on the 403(b) list! (The 403(b) is the IRS tax code for tax-deferred retirement plans for government workers. It is the equivalent of the private sector 401(k) plan).

I felt I was being treated like a 6th grader, admonished for asking impertinent questions. I had to write the names of each mutual fund on my own paper. And then, I had to research to find out which ones cost the least. The benefits clerk said it was against district policy to provide a list. Furthermore, she did not know which ones were no-loads. Zero help!

What was wrong with this picture? I wanted to invest 100% of my money in one of the lower-cost investments that was already approved! Instead, the district treated me like a barnyard parasite for asking. Had I been treated with respect, my book, Fighting Powerful Interests, would have never needed to be written.

We already have a Pension!

Public School K12 teachers do not need a “guarantee never to lose money in the stock market.” That’s what pensions do. I also discovered that my union only had high-cost plans on the “Union Approved” list, which was terminated in 2008. Thank Goodness! I wanted to stop this self-conflicted 403(b) system of our union members getting sold high-cost and non-investment products.

Throughout the business of economics and investing, every financial planner, adviser, or other financial expert I talked to said that annuities had high costs with pathetically low returns. An annuity is an insurance product that is wholly inappropriate for building a nest egg because of its high costs and caps on returns. What was insane is that nobody was talking about this in any public way. UTLA had a retirement committee that I attended for years, and their focus was on CalSTRS, our pension plan.

I started writing letters to the board of education and benefits personnel asking questions. I also explained the situation to the UTLA union newspaper editor, who accepted and published my articles. Thus, from 1996 to 2008, I wrote about the 403(b) low-cost alternatives for the United Teacher-Los Angeles (UTLA) union newspaper. Many union members responded positively (the annuity salespeople were not happy).

I also got lucky when I reached out to the mainstream print media. Over the years, many mainstream media reporters quoted me about my experience with the sad state of 403(b) plans, including the Los Angeles Times, NY Times, and U.S. News and World Report. Because of the Los Angeles Times article, I found twenty-five LAUSD colleagues with the same concerns and wanted to do something. With two colleagues, we co-founded an investor self-help group called 403bAware for teacher colleagues.

I testified at California state legislative hearings to change state laws that protected insurance salespeople rather than teachers. My teachers’ union eventually recognized and honored me with the “Unsung Hero” award for my retirement planning advocacy.

My Second Life—Retirement and My Commitment to the LAUSD Advisory Committee!

For 17 years, I have volunteered on LAUSD’s Investment Advisory Committee as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s new tax-deferred retirement plans, 457(b).

Enter the New 457(b) Plan!

When the 457(b) was launched in January 2007, it began to reflect my image of low-cost genuine investments, just what my colleagues and I were asking for. No annuities. Over the years, we swapped out the higher-cost mutual funds for lower-cost index funds from Vanguard and Blackrock. As a result, LAUSD won a rare Plan Design Award in 2014 from the National Association of Government-Defined Contribution Administrators (NAGDCA). As of June 2020, 11,000 LAUSD employees with about $200 million in combined assets are invested in the 457(b). And it continues to grow.

The 60-year-old 403(b) plan has $2.8 billion in assets with about 55,000 LAUSD current and former employees. When the enrollment decreases, the annuity sales force continues to sell its high-cost plans to our LAUSD colleagues. While the district has a policy prohibiting on-site presentations of 403(b) products or meeting with teachers on the school property or during professional development workshops, they often openly violate his policy. The free lunches are too tempting for district professional development coordinators, office managers and school site principals to resist. They think they are doing a good thing for teachers, BUT THEY ARE NOT!

Eighty percent of the 3.3 billion assets are in high-cost annuity products or high-cost mutual funds with expensive advisory fees. Two low-cost plans are available on the 403(b), CalSTRS Pension2 and the giant pension TIAA, which are familiar to higher education faculty.

Why I started this Blog

I started this blog in 2012 to help all PreK-12 public school educators nationwide, especially my Los Angeles Unified School District colleagues. I belong to a small national group of 403(b) advocates (mostly teachers) who want to draw closer attention to the 403(b) and support the new and lower-cost 457(b) plan.

During the past 25 years, 40 newspaper 403(b) related articles have been published. Each one says the same: TSAs (Tax Sheltered Annuities) are terrible 403(b) plans. The only one who benefits is the salesperson, who receives lucrative commissions, high costs, and other benefits such as complimentary trips to Tahiti, Hawaii, and other exotic places. Nobody in educational leadership or many teachers read these articles. And we don’t know why….

Action Plan: Our Advocacy is Growing

The following links are to get my free books and to get more information about stopping, getting out or transferring a high-cost plan to a low-cost plan.

It is also for those advocates who want to help colleagues with their 403(b)s. If you are helping yourself get straightened out of the annuity product and into a genuine and lower-cost investment, we are here to help with resources so you can help your colleagues too.

We meet at 403bwise.com and 403bwise.org on Facebook: https://www.facebook.com/groups/349968819000560/. Come join us if you want to help our colleagues avoid these self-conflicted and high-cost Tax-sheltered Annuities (TSAs).

I was so angry that I was taken advantage of that I authored two books, Late Bloomer Millionaires and Fighting Powerful Interests: Educators Challenge Tax-sheltered Annuities and WIN!, a story of how a handful of LAUSD educators struggled for years to improve the 403(b). Fighting Powerful Interests is written explicitly for LAUSD teachers! This book expands on my story with LAUSD, UTLA, and AFT, where I was on the selection committee in 2002 when AFT selected a national 403(b) vendor. It is all there, and it’s fascinating. You will learn about tax-deferred retirement plans with LAUSD and how to become a savvy investor to grow your volunteer supplemental retirement plan.

I have learned that most people want to do the right thing for all LAUSD employees, but powerful obstacles in their own interests block reform. Find out what they are by reading Fighting Powerful Interests, so together, we can fix the 403(b) for future generations of teachers.

One definite answer to the high-cost 403(b) is the non-biased and low-cost 457(b) plan. You will learn firsthand what the 457(b) plan is and why one insightful and compassionate benefits administrator brought it to LAUSD. He also asked my friends and me to serve on the volunteer advisory committee.

My LAUSD friends and I never quit! As mentioned before, we were instrumental in LAUSD’s implementation of the new 457(b) plan and earned an exceedingly rare but very precious “Plan Design” award.

For a FREE copy of both books, email me at steve.schullo@latebloomerwealth.com and I will happily email you both books, FREE with no obligation except to read them and get informed, in a pdf file format.