A Critical and Objective Book Review of The Behavioral Investor by Daniel Crosby

Reviewed By Former Licensed Therapist Steve Schullo, Ph.D.

Amazon Review: 2 stars for an incomplete strategy, unnecessarily bashing passive strategy, and omissions of great investors. But a MUST read!

The Fear of Missing Out

The Behavioral Investor includes good qualities in defining psychological biases. Still, the author’s approach to presenting his material was overwritten, overexplained, emotionally laden, and negative. FOMO is the first omission throughout the book. Millions of investors earn average returns and save billions in costs from the passive strategy. Still, after reading this book, readers might experience the fear of missing out. The author is trying to sell a combination of chartists and momentum, focusing on prices, Buffett’s and Graham’s Value style investing, and using psychology to keep the zero-sum game of “I win, you lose.” If readers can accurately achieve the ultimate author’s goal of earning above-average returns through yet another tactical sales pitch requiring a ton of skill and knowledge exhibited by Ben Graham and the successful practice of Warren Buffett, my hat is off to you.

I had already read two of Crosby’s other books, so I know this author’s (and the publisher’s) emotions and purpose too well. This book may benefit some readers who currently have an all-passive strategy to practice by ignoring the powerful FOMO. Don’t be tempted to think that what this author proposes is right for you. I know it is NOT right for me! I hope that readers might convince themselves and their loved ones a huge favor and construct a low-cost, fully diversified portfolio with a fixed allocation, stay the course, and get reasonable returns.

Figuring out the Stock Market and Investors?

Please ignore the emotional trap of thinking you can figure out the stock market and investors by reading this book. You won’t and never will. I know absolute words turn people off. But we are not discussing ordinary life here. We are discussing the stock market, which involves money (lots of money), nanosecond high-speed trading, action, highly trained and accomplished professionals, and the most powerful industry on earth with random and predictable emotions that runs this country!

Psychological Laboratory

This book is about investing, where the entire industry is one huge psychological lab experiment. The author teaches another tool, psychology, so you can analyze, comprehend, and understand the millions of irrational and rational gyrations occurring daily in the stock and bond markets because this author says so? is boarding on insanity, in my humble opinion.

Insanity or not, I am excited to recommend reading this book for the following reasons. My older brother was a verbally abusive, paranoid schizophrenic, and quite insane but very bright. He taught me a few life lessons, which I practiced my entire life by earning two psychology degrees (so I can understand myself and him) and playing chess.

Why I Read this Book!

So, insanity can be a good teaching tool. Here is why I was and still am excited I read this book:

- Rick Ferri interviewed the author. Rick has been a long-standing Boglehead and interviewer with the Bogleheads on Investing Podcast, an accomplished author and committed to the Boglehead approach to investing.

- The author majored in and started a career in psychology. Like my experience, he was a former licensed psychotherapist who didn’t find meaning in counseling others.

- I read many books and listened to podcasts on the emerging behavioral finance literature, qualitative vs. quantitative. This book’s review of the literature contributes to the behavioral finance movement from an academic point of view.

- So, I was extra hyped to read another book focused on psychology and financial literacy and the crucial area of behavior finance that is coming of age.

- This book adds to the qualitative part of investing. Knowing your thinking and the emotions behind your decision-making are excellent steps in the right direction.

SPIVA 20-year Research

Suppose you follow the author’s recommendations that you can select the winning 20 to 30 individual stocks. My hat is off to you. Selecting stocks is what the entire financial system is about. The facts are by S&P Index Versus Active (SPIVA) research over the last 20 years, and active management has not been able to consistently select winning stocks that beat the averages over the long term. It is gambling and speculation depending on 100% luck. Being lucky sometimes works and pays off hugely, but it is only a short-term strategy. I know investors who struck it rich by owning Tesla stock and bet the farm on it, and it took off. But that kind of story is useless and unreplicable. I will NEVER buy individual stocks. But I digress.

Sales Pitch

This author’s primary sales pitch is clever for the unsophisticated, unfortunately. He uses psychology to jungle our way through the world’s largest psychological jungle, the financial markets, to earn returns above those boring averages. The conflict between the dominant, sophisticated, and highly respected quantitative analysis and the rising star of qualitative analysis, storytelling, emotions, and psychology was addressed only to exploit less sophisticated investors on the other side of the trade, especially the passive strategy and other overconfident and hyperactive active investors who would never think that their emotions might sabotage their returns.

Unlike the author of The Psychology of Money by Morgan Housel, who wrote the foreword of one of the author’s other books, stories are omitted (one of many omissions). The author kept a solid foot in the statistics and numbers, citing past data to support his value style emphasis with 20-30 individual stock portfolios and only comparing the S&P 500 (passive investors never invest in only the 500). He cites Warren Buffett frequently as active investors often point to Buffett’s success over the decades, through his active investing strategies, returned about 25% return annually since the 1960s.

Something About Buffett

What is hardly mentioned by many authors is that Buffett is not just an investor, he is an expert manager of companies. He also sits on boards of some of his companies and has massive access to industry insiders, journalists, and CEOs. Did you think we could pick up the phone and call Steve Jobs as Buffett did when deciding to invest in Apple? Of course not! Besides, this author said nothing new about value investing; heck, my portfolio is tilted toward value investing in Vanguard Wellesley.

If you are looking for “the fruits of his labor,” you will be disappointed, but you should be angry! He meticulously plowed and cultivated the field, fertilized it, and was ready to plant his crop. But he left the field unplanted, so we don’t know what he planted, and we will never know what happened. The author should have finished the job by offering a sample of his portfolio of individual stocks and how his portfolio performed. What a glaring omission again!

Readers are on their own with tremendous research to find those beaten-down value stocks. What an odd and blatant omission and the author and his publisher think nobody would notice. Unbelievable. That’s why I found this book so amazing!

Readers will never know how his “psychological” strategy works. He plows (pun intended) through page after page cherry-picking outstanding citations from everyone from ancient and modern philosophers, psychologists, and statisticians to support his view of exploiting psychology to create a zero-sum game in which readers will benefit.

Quotes, Quotes, and MORE Quotes!

I agreed with many of the quotes as they also support the passive strategy! But the author went in a different and dangerous direction because it is the status quo of investing by millions of active investors who religiously follow Jim Cramer. The author wrote, “There is no understanding of markets without an understanding of people.” Sounds good, but the author twists it a bit so that it’s mostly about understanding your psychological biases and taking advantage of other people’s unconscious and psychological biases.

Positive takeaways:

- His best contribution: He lists and defines the “most,” but not all, psychological biases that sabotage investors.

- He is encouraging and inspiring to the active investor audience, which is the majority of all investors, despite what he says that passive strategy is just as, or more, popular than active. NO WAY! Active investing rules the financial industry. Just look at Jim Cramer’s popular show “Mad Money” with his 380,000 daily viewers! According to this author, all you need is a laptop and a spreadsheet, do a little research to select those 20 individual companies, and you are all set up to beat those terrible passive strategy averages. He omitted what Charles Ellis said in his many books. Investors could never compete with the thousands of highly sophisticated traders, analysts, and brokerage firms. The professionals are Ivy League trained, employ powerful computers, have access to teams of researchers with reams of information, and have been trained for years to analyze companies. That takes courage or perhaps a little insanity, IMO, to inform the average active investor that they can do better. Average investors will never know who they are trading with on the other side of the table (Flash Boys by Michael Lewis).

- He talks about the value style of investing, which has a long history of higher returns (but with more risk) than the total stock market index.

- The book has hundreds of quotes from around the world of investing, including the Bible, which are excellent.

- This book would be an excellent textbook for an academic course.

Negative takeaways:

- The author assumes that readers will do all necessary work to beat by 3 or 4% more than the boring US Stock market average (10% average return in the last 100+ years). He cites Graham frequently because of his value investing and only needing about 10 to 20 stocks. However, Graham realized that many readers want to live without a 24/7 80-hour workweek managing investments. And then, even after all that work researching and vetting your 20 companies, readers do not do as well as the indices. Hundreds of books, articles, podcasts, academia, and financial magazines preach with reams of data that say to invest in the indices (20 years of research by SIVA).

- His explanation of the “rules-based” strategy is wholly complicated. I have two degrees in Psychology and practiced psychotherapy, and I was in therapy myself for years. His introduction reads like a Ph.D. unpublished dissertation with paragraph after paragraph explaining how we think. After a while, I got a headache! The content is familiar to me, but at times he has way too much information and over-explains psychological concepts. If he and his publisher want to reach a larger audience, this book needs to be scaled back with fewer references to the literature, delete the vast number of quotes, and simplify explanations of everything! 50% of nonfiction books are ghostwritten.

- A colossal omission: Jack Bogle and the dozens of Boglehead authors, including THE Boglehead, who interviewed him, Rick Ferri! I KID YOU NOT! One of Rick’s popular books is “The Power of Passive Investor.” All people who have any basic knowledge of investing will totally agree that Bogle is one of the greatest investor/innovator/contributor to the average person. This author claims to challenge the status quo with this book but appears not to have any idea what Bogle experienced in the last half-century. Bogle single-handedly and courageously challenged Wall Streets’ most powerful goal, profits through high costs and massive profits for themselves. Crosby completely failed to acknowledge this man’s historical work. The author missed a great opportunity to build on what Bogle contributed. But since the author’s work is the polar opposite of Bogle, perhaps the author had little to nothing to build on.

- Omission of sample portfolio of his individual value stocks and their performance.

- Another omission is that investors are left to defend themselves against the power of the regulations coming out of DC that failed to require fiduciary regulations for ALL financial professionals. Some readers may hire an expensive professional adviser using the Assets Under Management (AUM) business model to actively manage their portfolios. Heaven forbid!

- He didn’t mention costs in his individual stock selection. Owning individual stocks has zero fees! An advantage over an all-indexed portfolio.

- He commits what most active investor devotees do by proclaiming an idea with a false equivalence. He says the Wall Street committee changes the S&P 500 index is just as frequently as an active mutual fund manager! According to Business Insider, the 500 has a 4.4% turnover rate. The average active fund is between 10% to 90% or more turnover rate. This author made it sound like they are equivalent when there aren’t. It’s not even close! But the author is convincing and has plenty of charisma, especially if you don’t know the data.

- Focuses on stock prices in which an investor must time every step correctly, purchasing the stock below value (by the Price to Earnings PE ratio and Price to Book PB ratio data, and other data that is also researched by the entire Wall Street industry!) and selling it when the PE and PB data get above fair value. Then the active investor must replicate the same buying and selling process over again with perfect timing as the portfolio’s high-priced stocks get sold to make a profit and purchase new lower-priced securities that have been correctly vetted for future growth.

- Never mentioned if his strategy of owning those 20 value stocks is short-term or long-term.

- Too many quotes evolved into distractions and were annoying, IMO.

- He uses words that I have a problem with, such as “truth” and “vetting.” IMO, in the investing world, there is little truth, and vetting individual stocks is best set aside and owning the entire stock market instead. Any “true” data is in the past, but it’s 99% useless. You can use the 1% of past data for risk analysis in setting up your portfolio. It is also almost impossible to vet a potential company so that I will know with confidence that it is going to grow.

Summary,

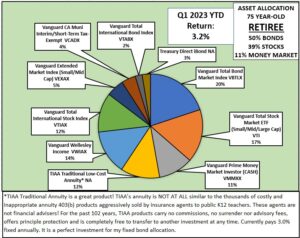

After reading this book, I am more confident (which is hard to beat anyway) that my fully diversified worldwide stock and bond market indices with extremely low costs will continue to do the job for my best financial interests. Here is my boring portfolio, complete with asset allocation and Q1 return. This simple portfolio has served me well in my retirement.

Steve’s Portfolio (NOT THE AUTHOR, He never shared his! A huge Omission)

If you are on the fence between choosing an active management strategy as proposed by this book versus a sensible, simple, low-cost passive management strategy with reasonable returns, I hope you will be encouraged to ignore this author’s basic sales pitch for simplicity’s sake. Use this author’s psychology contribution by sticking with your plan over the long term, and you will be able to sleep at night and earn enough to meet or beat inflation. It’s that simple. The author admitted that the passive strategy has “advantages.” But those passive strategy advantages are priceless. Don’t ignore them.

Steve’s Bio

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and UCLA Extension teaching educational technology to student teachers.

Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) union newspaper for 13 years. Thrice featured retirement plan advocate in the Los Angeles Times and U.S. News and World Report. He co-founded an investor self-help group 403bAware for teacher colleagues and wrote 7,500 posts in three investment forums since 1997. Frequently quoted by the media, he testified at California State legislative hearings and was honored with the “Unsung Hero” award by UTLA for his retirement planning advocacy.

For the last seventeen years, he serves as a volunteer on LAUSD’s Investment Advisory Committee as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s tax-deferred retirement plans, 457b/403b, of 55,000 former and current LAUSD employees, worth $3.1 billion in total assets.

He started this blog in 2012 to help all PreK-12 public school educators nationwide, especially his Los Angeles Unified School District colleagues. He belongs to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b). During the last 25 years, over 40 newspaper articles have been published and each one says the same thing, TSAs (Tax Sheltered Annuities) are terrible 403(b) plans. Over and over again, the articles report that the salesperson gets the benefit from lucrative commissions and high costs. Nobody in educational leadership reads these articles NOR talks about the proper place for annuity products publically. We come together at 403bwise.org. Come on over if you want to join us so we can help our colleagues avoid these self-conflicted retirement plans, TSAs.

For a copy of both books, click on my home page and scroll down to the two books. Click on each book and download it FREE. No obligations as I am not a financial adviser.

Email Steve at steve.schullo@latebloomerwealth.com or ask your question after each post.

Pingback: Year-to-Date Half Way Mark 2023 Portfolio Report by Steve – Late Bloomer Wealth