My Latest Good News on My “Modest Proposal.”

By Steve Schullo

Member-at-Large, LAUSD Retirement Investment Advisory Committee (RIAC)

If you read my previous post just published the other day, you read my thinking, analyses, and my purpose for undertaking a major revamping. Let me be clear, the current plan is a great plan. While the financial world has changed dramatically, and the current 457(b) reflects that financial world in 2012. It is time to update with the reality of 2023. The current plan duplicates investments that cost more than the index funds, and the assets from higher-cost funds can be migrated with similar asset classes to the index funds.

Let’s face it, 19 choices are over the top and too complicated to understand. The current plan has enough index funds to have the higher-cost fund assets migrate to the broadly based index funds. I calculated by reducing the duplication and increasing diversification, I come up with ten investment choices and the brokerage account.

Just to review: I included the present 457(b) plan and my Modest Proposal 457(b) plan. (If you missed my previous blog about my thinking and rationale for updating the plan, click here.)

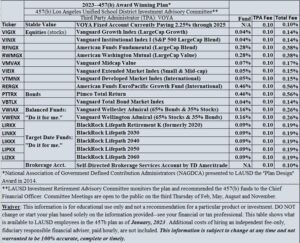

This is our current and Award Winning 457(b) plan.

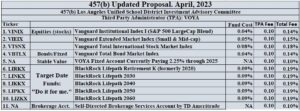

Below is a revamped and updated 457(b) Modest Proposal presented and discussed at the ad hoc investment committee on April 20, 2023:

Hello colleagues!

Welcome back. I am so happy you are interested in our retirement planning future. You should be for many beneficial reasons. The 457(b) plan is a genuine and potentially powerful benefit available to all full-time LAUSD employees along with our health, dental, vision, and our wonderful CalSTRS pension benefit. But not much is discussed publically about the 457(b) plan, and so this is the primary reason I created this blog to let LAUSD employees know that it exists and other issues related to the district’s older 403(b) and the newer 457(b) plan.

On April 20, 2023, the subcommittee accepted my proposal, in principle but for continued discussion, to update and revamp the 457(b) plan!

The committee decided, with our professional consultant NPF, to roll out the changes in two steps detailed below. The first step is immediate, with a motion to be passed by the full committee at the next May 18th meeting, at 3:00 via Zoom.

All motions passed by this committee are a recommendation to the CFO, David Hart, who makes the final decision. One never knows what the CFO decides, but the committee is optimistic that he will accept and approve these steps. BTW the RIAC meetings were and are always open to the public, and you are invited to listen in and/or speak during the three-minute window (we are informal, and you can speak longer).

Step 1: Deselecting the three funds on our consultant’s score card a complicated program that does in-depth analyses of the funds. The funds that get a low score are placed on a “watch list” and closely monitored to see if they increase their score. If not, this is the time to deselect them. These funds are also some of the more costly funds that we want to get rid of anyway. All actively managed American funds with high costs will be deselected if the CFO approves our motion. Nothing happens until the CFO approves. Upon approval, VOYA will send out three hard copy notices to notify those LAUSD affected.

If you are in one of those American funds, don’t be concerned. It will take time for the CFO to decide. Hopefully, reading this post and my previous post will answer your questions about why RAIC is making these changes. Let’s be clear, I am only one member of a 12-member committee. No one person unilaterally makes changes: Nothing gets done without full participation and input from the ad hoc and full committee first. After all that deliberation with our financial consultant is exhausted and ends with a motion, the CFO will review the motion with additional input from benefits and legal counsel, then make the final decision.

Step 2: By next fall, 2023, the ad hoc committee will meet again to hammer out and finalize a specific motion to bring to the full committee for a final vote, hopefully by the November full RIAC committee meeting. This step is more complicated as more people will be affected. How many? Of the 9400 LAUSD employees enrolled in the 457(b) plan, around 2000 will be affected, and 7400 will not. Surprisingly there was not much opposition to my modest proposal, but it is in the early stage of discussion and possible negotiations among the ad hoc investment committee members next fall. We are determined to get a motion to finalize the updated plan by this year or early 2024.

There is a lot to like about my modest proposal as presented. Investing in the stock and bond market significantly differs from the annuity 403(b) world. From the beginning of the RIAC, all collective bargaining reps and our first Chair, George Tishler, believed that LAUSD educators, and extending nationwide, would be more secure in their financial world with a diversified stock and bond portfolio rather than high-cost, illiquid, and low-performing annuities. We don’t need a guaranteed product as we already have CalSTRS, and having two guaranteed products makes no sense. Annuities are locked up, and if something happens to you and you don’t have a beneficiary option, your heirs get nothing. Annuities have a place in some portfolios, but not with public K12 because we already have a pension.

The updated plan reflecting the core investing basics will be easier to learn and start. Fewer choices make the onerous and high probability of choosing the wrong investment reduced. It is possible to understand how the stock and bond markets work and how the financial industry has created low-cost products that follow the highs and lows of the stock and bond markets.

My quarterly reports show how my low-cost diversified portfolio works with the stock and bond markets. If you missed my last report, click here for the first quarter report ending March 31, 2023.

Steve

Steve’s BIO

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and UCLA Extension teaching educational technology to student teachers.

Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) union newspaper for 13 years. Thrice featured retirement plan advocate in the Los Angeles Times and U.S. News and World Report. He co-founded an investor self-help group 403bAware for teacher colleagues and wrote 7,500 posts in three investment forums since 1997. Frequently quoted by the media, he testified at California State legislative hearings and was honored with the “Unsung Hero” award by UTLA for his retirement planning advocacy.

For the last seventeen years, he serves as a volunteer on LAUSD’s Investment Advisory Committee as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s tax-deferred retirement plans, 457b/403b, of 55,000 former and current LAUSD employees, worth $3.1 billion in total assets.

He started this blog in 2012 to help all PreK-12 public school educators nationwide, especially his Los Angeles Unified School District colleagues. He belongs to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b). During the last 25 years, over 40 newspaper articles have been published and each one says the same thing, TSAs (Tax Sheltered Annuities) are terrible 403(b) plans. Over and over again, the articles report that the salesperson gets the benefit from lucrative commissions and high costs. Nobody in educational leadership reads these articles NOR talks about the proper place for annuity products publically. We come together at 403bwise.org. Come on over if you want to join us so we can help our colleagues avoid these self-conflicted retirement plans, TSAs.

For a copy of both books, click on my home page and scroll down to the two books. Click on each book and download it FREE. No obligations as I am not a financial adviser.

Email Steve at steve.schullo@latebloomerwealth.com or ask your question after each post.

Bravo Zulu (Navy Speak for well done.)

Of course, we should all remember what happened to the 403(b) proposal years ago in San Diego when politics got in the way of common sense. It’s not over, until it’s over.

This really great news. Perhaps school districts across the country will learn some important lessons from your fine work Steve. And that of the committee!

LAUSD employees should sharpen their pencils and show themselves the saving these lower cost funds will mean to their retirement nest eggs.

Good Show.

Of course, we should all remember what happened to the 403(b) proposal years ago in San Diego when politics got in the way of common sense. It’s not over, until it’s over.

This really great news. Perhaps school districts across the country will learn some important lessons from your fine work Steve. And that of the committee!

LAUSD employees should sharpen their pencils and show themselves the saving these lower cost funds will mean to their retirement nest eggs.

I have not said all this before. It should be posted again. Ted Leber

Pingback: Year-to-Date Half Way Mark 2023 Portfolio Report by Steve – Late Bloomer Wealth