Hi friends, family, and former teacher colleagues,

That time of the year again, halfway through a very rocky stock market year. I have been through three prior stock market corrections, crashes, or bear markets since 2000. I only share my portfolio for two reasons: to show you how a low-cost, diversified, passive strategy portfolio follows the market and what I am doing now. That’s it.

The portfolio is Down, but I am not concerned!

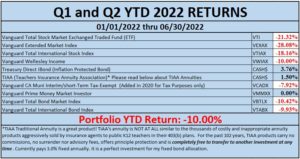

The returns posted below should be of little surprise as most of my investments are negative YTD. The overall market is down year-to-date, so my portfolio was constructed to do precisely that–follow the market.

Bonds Keep Volatility Low

Some investors decree that bonds are a terrible idea. I totally disagree. Investors must be reminded that bonds are part of the fixed income allocation needed in most portfolios, especially for retirees like me. One does not make money off of bonds, my portfolio includes them for preservation, such as what we are going through currently. One makes money with proper exposure to stocks. My 33% in stock indexes shows that it is important even during the retirement years. A balanced portfolio of stocks and bonds assures the investor of returns that keep pace with inflation (Yes, inflation is high currently, but I will not be discussing inflation in the post). Some years, bonds outperformed stocks. For long periods of time, stocks outperform bonds by about 2 to 1, an average of about 9.5% annual return for stocks and about 4 to 5% for bonds for the last 90 years.

Bond Funds decline in the short term.

We all know that this year bonds also took a hit too, but their value declined. All my bonds lost about 10%, so the fair question is that preservation? Ah, of course not IF I looked at only the value and in the short term. Always remember that long-term thinking involves bonds, stocks, and real estate. Bonds have value AND yield! When interest rates rise, the value of my bonds decreases (except for inflation protection iBonds). Investors turn their backs on bonds because their value decreases, as we see in our portfolios. I think they forget that eventually, the interest rate increases this year will result in a higher future yield in the Total Bond Market Index fund I have held in my portfolio for many years.*

Loving the Psychology of Money

But some people forget that many, including myself, have complained about the low-interest-rate environment for years because we were earning nothing in savings and money market accounts!

Why Are These Two Gentlemen Angry?

Now that interest rates increased, some scream bloody murder. Why? One fellow commented on my pie chart (below) on one of the investment forums on which I post stuff, “Bonds? Who on earth would recommend bonds in your portfolio?” I replied, “Jack Bogle and many authors.” He was so angry. His response was deleted.

This is not the first time a stranger has been angry at my AA plan! One guy shouted at me at an American Association of Individual Investors (AAII) meeting only because I replied to his comment, “I’m worried about the future as I was fully diversified with a stock-bond split.” He drew the attention of dozens of people! I kid you not!

Some People take investing way too seriously!

Money, investments and the stock market bring out the worst in some people. They take their fake investing braggadocio prowess way over the top too seriously and are addicted to the super machismo, speculation, and gambling crap some investors unfortunately have.

Who gives a damn about my very boring, passive, indexed portfolio that I share every quarter and every year. I don’t care if some stranger has the total opposite of my investment values: 100% individual stocks, thinks short-term, day trades, loves CNBC talking heads and especially Jim Cramer, and hates Bogle, all opposing value systems from mine.

As a Retiree, I Love Higher-Interest Rates!

I welcome higher interest rates. Bond experts say that bonds are basically a math calculation. My simple way of seeing how the math works is that the yield is awash when interest rates increase and bond value (the dollar amount invested) declines. If the price of the bond decreases and the interest rate increases, we do not lose money unless you sell it. Is that like stocks? You only lose when you sell it at a lower price than when you bought it. But there are two vastly important caveats, we have to think long-term and stay the course.

My Precious Vanguard Total Bond Market Index is Down

Of course, any idiot can see below that I lost 10.42%, BUT THAT IS THIS YEAR! Last I heard, that is a very short period of time. That forum poster did not know my bond’s maturity rate. Most of my bonds are in intermediate maturity, meaning that the current bond holdings in the Vanguard Total Bond Market will mature in 6-7 years. The manager will sell these terrible low-yield bonds and purchase new ones at a higher yield, which will happen gradually over the next seven years. While the price might remain the same now, the yield will provide a similar income for me in the future. Now that is the simplest way I understand how a bond fund works, such as Vanguards Total Bond Market Index (Of course, my explanation does not cover the whole of the bond market or how it works as many factors are involved). Fortunately, I will not be taking any money out of this fund for my RMD as I have TIAA, which is also my 403b money to distribute to the IRS. I anticipated higher interest rates six years ago, sold some of my Total Bond Market Index Roll Over 403b money, and transferred it to TIAA, which has paid 3.0% all these years. BTW, I sold it for $10.99 a share in 2016 (currently, it’s at $9.92 a share).

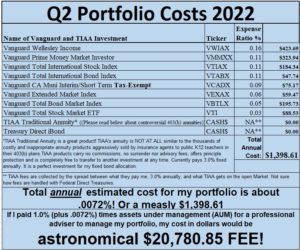

I Get Serious, VERY Serious, about Portfolio Costs!

When I said low-cost portfolio, I mean it! The dollar amount estimated for this year will be about $1400. This is a major advantage of self-managing my portfolio without an expensive financial adviser who normally charges 1.0% Assets Under Management. If I hired a manager for 1.0%, my cost would skyrocket to over $20,000! Multiply that amount for ten years–$200,000 in cumulative costs per year plus the loss of returns due to loss of equity over time.

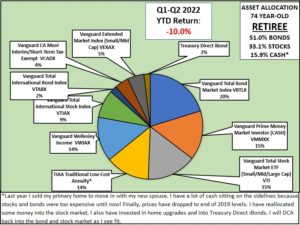

I Never Thought of Myself as an Artist!

Here is my beautiful portfolio, all ready for a big show for you! As I have said before in my quarterly reports, my portfolio looks complicated because, according to Jack Bogle, known to millions of investors, and CL Collins, the author of The Simple Path to Wealth, it IS complicated for newbies. If you are starting and want to learn more, follow Bogle and Collin’s advice.

My Investing Career is Different From Most Investors

I am in a totally different place in my investing adventure. I have been retired for 14 years. If I am lucky, I may have about 8 to 10 years of quality life left. My portfolio reflects that reality, and I have a story behind each piece of my beautiful pie.

- Taxes: My portfolio is about as tax efficient as possible.

- I distribute about $50,000 annually, about $33000 for RMD and the rest from my cash reserves.

- I reinvest distributions because my investments sell for much lower prices than before this bear market.

Purchasing Shares While They are Cheaper Than 2021! OMG, a lot Cheaper; thank goodness for this bear market opportunity!

Because of the 15% cash reserves, I have bought International Stock Market Index and Extended Market index to rebalance back into stocks at these low prices. I have waited until the prices are about the same level as before COVID struck and the feds poured money into the economy, inflating stocks and bonds to astronomical levels. I waited almost a year with cash to buy back into stocks because I REFUSE TO PURCHASE EITHER STOCKS OR BONDS AT THOSE UNSUSTAINABLE HIGH PRICES at the end of 2021, which were inflated with all of the Federal Reserves money.

Why I Use Dollar Cost Averaging and not lump sum

I made a lump sum mistake when my late spouse and I sold our Los Angeles home and lump sum the proceeds into our diversified portfolio in AUGUST 2008! We all know what happened the VERY NEXT MONTH! Wow! Was that bad timing when I could have DCA? Duh! and bought with much lower prices in 2009.

From that time on, I have kicked myself hard to dollar cost average (DCA) and vowed never to lump sum again. Last summer, 2021, low and behold, the markets were setting records when I sold my house, and I waited patiently until the markets finally corrected. Let me be clear. I did not forecast anything. Nobody knows the future. So, I am still sitting on cash, but this time I will continue DCA back into stocks and Treasury Direct iBonds as I see fit. I have also invested in our properties with new bathrooms, new windows, and other upgrades.

BTW, I Am Retired and Happily Married. We Traveled Recently!

Also, we are retired and starting to enjoy traveling again. We just returned from a wonderful week up the California Coast to where the Human Potential Movement started, Esalen. What a relief! We were with a group of like-minded people from around the country involved with all spiritual practices that add depth and meaning, yoga, meditation, sharing, hot tubs overlooking the stunning Pacific, massages, healthy food, peaceful walks through the 20-area coastline campus, and comfortable accommodations. It felt so good that Esalen is reality, the way humans could enjoy and reduce suffering. When we returned, it was unreal, with all the negative vibes. People are better than what we hear in the mainstream media, as we experienced firsthand at Esalen. Thank goodness Esalen has survived for 60 years.

Returning to Boston, The Cape, and Brief Visit to Ellis Island in NYC

Next month, we are off to Boston, the Cape, and NYC to Ellis Island. We are going to do some research on our families. My mother went through Ellis Island; all she remembered was the shot. Oh, did I mention she was three years old, and it was 1912? Yes, vaccines were available at that time, and last I read, nobody was complaining because people knew firsthand that all kinds of available diseases could kill and are prevented with a shot. It must have been a miracle in those days.

Here is my asset allocation. It has not changed much during the last 5 or 6 years.

Talk to you again, my friends, when I report back in October with my YTD portfolio. Please remember, no matter what your age, start saving and investing, pay yourself first, and stay the course. If you are a young investor, you should welcome low stock and bond prices and keep DCA in your diversified portfolio with your tax-deferred 401(k), 403(b), or 457(b) employer-sponsored plan. Your portfolio should be 80% or 90% stocks and the rest bonds, never purchase an annuity during your accumulation years. I think it would be wise to invest in some bonds just to learn how they work. Pay yourself first for your entire working career. You will NEVER regret it.

Best of fortunes,

Steve LBW Late Bloomer Wealth

*DISCLAIMER. Please do not rely solely on my blog post here if you are wondering about your bond allocation or thinking about adding a bond fund. I am not a bond expert. Heck, I am not an investment adviser either. I never was and never will be!

I have only shared my experience with my bond holdings. If you have questions, just Google bonds, and you will get dozens and dozens of excellent blogs or articles about bonds and what to do during this environment and in the future. I had already anticipated increased interest rates, and the primary reason why I traded some of my total bond market index rollover 403b money into TIAA Traditional Annuity paying 3.o%. I will meet my Required Minimum Distributions by taking from TIAA because I do not want to sell from the Total Bond Market Index.

If you are serious about including more fixed accounts in your portfolio, read Russel Wild’s bond books, you can start with this one I read years ago: Investing in Bonds For Dummies, then talk to an expert, tax, or financial professional about your portfolio.

Steve’s Bio

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and UCLA Extension teaching educational technology to student teachers. Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) union newspaper for 13 years. Thrice featured retirement plan advocate in the Los Angeles Times and U.S. News and World Report. He co-founded an investor self-help group 403bAware for teacher colleagues and wrote 7,500 posts in three investment forums since 1997. Frequently quoted by the media, testified at California State legislative hearings, and honored with the “Unsung Hero” award by UTLA for his retirement planning advocacy.

For the last sixteen years, he has volunteered on LAUSD’s Investment Advisory Committee as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s tax-deferred retirement plans, 457b/403b, of 55,000 former and current LAUSD employees, worth $2.5 billion in total assets.

He started this blog in 2012 to help all PreK-12 public school educators nationwide, especially his Los Angeles Unified School District colleagues. He belongs to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b). During the last 25 years, over 40 newspaper articles have been published, and each one says the same thing, TSAs (Tax Sheltered Annuities) are terrible 403(b) plans, and the salesperson gets the benefit from lucrative commissions and high costs. Nobody in educational leadership reads these articles NOR talks about the proper place for annuity products publically. We come together at 403bwise.org. Come on over if you want to join us so we can help our colleagues avoid these self-conflicted retirement plans, TSAs.

Steve is the co-author with his late husband, Dan, of their book on learning the investment process from the ground up, Late Bloomer Millionaires. It’s a heartfelt story about two ordinary chaps and how they discovered investing and money management without a professional financial adviser. They list all their successes and massive mistakes and still retired earlier than most Americans.

For a copy of both books, email Steve at steve.schullo@latebloomerwealth.com, and he will happily email you both books, FREE with no obligation except to read them and get informed, in a pdf file format.