Happy Belated New Year, everybody!

As the Worldwide Epidemic Decreased, so did my portfolio, and probably yours. You are not alone.

But there were many more positives in 2022 than negatives.

January 1st 2023, Sunday morning, 5:12 AM

Before I comment on my portfolio and how it reflected this past terrible stock and bond market year, I report what mattered to Georgiana and me during 2022. Life after the career is more than about watching finances. It’s about living purposefully and looking out for others rather than oneself. During these past three years, COVID has affected us in numerous ways, some positive but others not so positive. In hindsight, I hope that 2022 will be viewed as a transitional year where, looking forward, we can get back to socializing without fear and working on our projects. As you will read and see, Georgiana and I did a lot, and despite what the stock and bond market did, I was not worried about finances. I hope you enjoy my lengthy post about 2022, and I hope will all enjoy more of this in 2023.

Birthdays!

After we exchanged Happy New Year pleasantries, Georgiana asked me, as the Times Square Ball was falling, what was my favorite 2022 event? We had many events, but I said our 2nd wedding anniversary party on March 21 when our wedding party met in person for the first time. She had been looking at all the pictures we took in 2022 to choose a select few to use in her Christmas and Happy Holiday Cards she worked hard to create. She said that while the first three months were challenging, the year went great from our anniversary party and on.

Esalen Lives On

I also mentioned our consciousness rising workshop at the famed and historical Esalen, where the 1960s human potential movement was born. On our road trip to Esalen, located in the middle of California’s spectacular coast, we stayed at a quiet hotel at Pismo Beach the first night.

Georgiana enjoys one of the world’s most famous and fantastic-looking coasts–the California Coast!

After checking into our Pismo Beach hotel room and unpacking, I recall how we sat quietly for a few minutes and soaked up the absolute stillness! I’ll never forget it, which is a highlight for me 2022. Einstein said that he enjoyed quietness later in his life. I never forgot that smart man’s experience. At Esalen and 40 other participants from around the country and Canada, we sat for three days in meditation and presentations to think and look for ways to address the many harmful modern life distractions that take away our otherwise peaceful minds. Esalen is located near Big Sur and right on the majestic California Coast! This location itself, with a wide-open view of the coast, will take away stress at a moment’s notice.

Thinking Long Term (not only investing!)

So far, our health is fine. Perhaps we will keep wearing masks for the rest of our lives. Like stock and bond investing, we consider wearing masks for long-term protection. For years, I saw mostly Asians wearing masks in crowded public places such as airports and malls. Long before COVID, my friend Janet wore a mask on our flight to Vietnam five years ago! I think we will see more Americans permanently wearing masks because it keeps us free from all communicable diseases, not just COVID but the common cold, annual flu, and RSV.

Georgiana mentioned our stay in Cambridge, MA, and Cape Cod as a 2022 highlight. I couldn’t agree more: the big house on Wellfleet that we shared with Georgiana’s niece and her family, quiet walks to the beach through the Cape Cod woods, a huge family reunion with the Italian side of her family, Boston Museums, and visiting her brother and his wife as major highlights from 2022. When we returned from Boston, she also fondly remarked about seeing the famed 1980s music group Duran Duran at the Hollywood Bowl.

For decades, I have always loved every performance at the Hollywood Bowl. Whether it’s a comedian, classical, rock, jazz, or Sound of Music Sing Along, the Bowl inspires with mysticism, seriousness, or humor, modern or traditional, with a 100-year tradition of a special place to picnic and listen to music on a hot summer Los Angeles evening.

This is US was our favorite TV series in 2022 and perhaps our all-time favorite. The long story from birth to grown-ups, and everything in between, we followed three siblings of mixed race with white parents and their triumphs, disappointments, sufferings, and joys to the most amazing end of a long story ever written, acted, filmed, and produced. You have got to see it. It is worth every minute of the 106 episodes spanning six seasons from 2016 ending in 2022. I call This is Us Tolstoy’s Anna Karenina equivalent for America.

Back to Georgiana’s question, which I have not fully answered. From now on, I can predict my birthday as the best moment of the year. Upon further thinking with the risk of thinking only about myself, birthdays at my age are increasingly becoming a wonderful event. I think about the billions of humans throughout human history going back 50,000 years or more who never came close to 75 years. Back in the 20th century, my father lived to only 61, and my grandparents (my father’s parents), shown here taken in 1933 on the Wisconsin farm (where I grew up), lived beyond 75.

My father was unlucky. His childhood untreated rheumatic fever left a debilitating side effect for the rest of his life–an enlarged heart with a significant loss of energy. Though he was able to manage a farm and work very hard, his heart eventually failed him at 61. Dan, my first spouse, didn’t make it to 75 either after his second cancer. So I have much to be thankful for as I am in good health at the moment. Like the stock market, there are no guarantees of good health moving forward. I have to live with uncertainty. Like my diversified portfolio, I take care of my health on the things I can control–A healthy diet, meditation for peace of mind, regular exercise, and regular checkups.

My long-time friends Frank and Val

Usually, when a spouse dies, the couple’s friends begin to shy away from the lone survivor. NOT Frank and Val. They have been friends with Dan and me for 45 years. When Dan passed in 2015, they remained loyal friends! They were the first friends I introduced to Georgiana when we were dating. One of the many highlights of 2022 was attending a very impressive celebration at Loyola University, where Frank Sr. and Frank Jr. graduated college. But it was Val that was in the spotlight. The City of Los Angeles recognized Val’s outstanding work as an attorney and member of the Los Angeles Airport Commission for many years. What an honor to be recognized by this great city, Los Angeles! Wow! She was acknowledged in front of hundreds of people from many organizations with which she and her husband were involved. It was well deserved and not a surprise to me. BTW, Val was our wedding officiator, and Frank was my best man, and they went out of their way to do this for us at the beginning of the worldwide pandemic. That is the kind of people they are, thinking and caring about others!

Last Big Events of 2022: Christmas with My Family!

My California Family and My Wisconsin Family!

After 3 years of COVID separation from my family, Georgiana and I drove up to northern California for a family and holiday get-together! It was Christmas Eve 2019 when I proposed to Georgiana in front of the family. Since then, I have not seen my two great nieces and nephew, Hudson and Samantha, their parents Tamara and Jim, grandparents, who is Dan’s sister, Cathy, and her husband Glenn, and their two other adult children, Tod and Caroline, with her husband, David. Wow! Did the “children” grow up as wonderful young and intelligent teens. Georgiana felt as welcome as I did when I visited her family in Boston. I am so close to them that I forget they are my in-laws formally, but let’s forget being formal! THEY ARE MY FAMILY!!! And they loved Georgiana from the start! Georgiana says that she gained another family. It brings tears to my eyes to hear her say that. Her family has welcomed me into their flock as well. We are both fortunate to have such loving and wonderful people.

Wisconsin Family in Palm Springs! After our wonderful Christmas with my California family, we drove straight to Palm Springs to see my grand niece and her family from Wisconsin. Ashley did her homework! She searched the entire country, looking for the warmest place to spend Christmas, and found that Southern California was the warmest. She told me they would be staying in Palm Springs! I was very excited for Georgiana to meet my Wisconsin family for the first time. We had a wonderful dinner with her husband, Josh, and their delightful son, Jace! He hugged me as if he had known me for a long time. After dinner, we went to the Christmas light show at the Living Desert, an annual event that Georgiana and I had attended in past years.

Uncertainty and making mistakes are what humans fear the most, IMO!

At the end of this post, I have a piece devoted to handling one of the most challenging experiences of our human existence–uncertainty.

I read 11 books in 2022. Most were financially related, two were memoirs, one a grammar book and a book that presented a positive spin on our challenging times, Factfulness. I am working on Yake’s economic professor and Nobel Economic Prize winner, Robert Schiller’s latest and over 500-page massive book, NarrativeEconomics: How stories Go Viral and Drive Major Economic Events, and just started reading another one of Nissam N. Taleb’s books, Fooled by Randomness, not only about finances but life too.

- Charlie Munger’s Damn Right! written by Janet Lowe (Read My Amazon Review)

- Another book written by one of my favorite authors is Michael Lewis’ Flash Boys book (Read My Amazon Review).

- I read my absolute favorite author Nassim Nicholas Taleb Black Swan’s and Antifragile: Things that Gain from Disorder. I love Taleb’s thinking that what we see and hear as facts or certainties is not so certain. Our life is much more complicated than the world’s greatest mathematical calculations can ever clarify. He applies this thinking to not just money but historical events with the insights of a Buddhist monk. The world, including the world of money, is not what we think, and it is certainly not what we know either. His insights, thinking, and writing relates to what Buddha taught about emptiness.

- The (Mis)Behavior of Markets: A financial View of Financial Turbulence on fractals recommended and finance by my friends Arturo and Ventura. Fractals are highly mathematical and technical tools that might be useful in the near future. The financial world does not want too much transparency yet.

- Gone to the Woods by Gary Larson is a wonderful memoir about growing up in the midwest in a third-person POV.

- Grammar for Full Life by Lawrence Feinstein. Grammar has always been my weakness in my writing, so I learned a few more pointers and a different and creative approach to this otherwise very dry and dull topic.

- I reread Iron John from the 1980s by Robert Bly. Because of all the gender role changes, I thought it would be a good idea to revisit what Bly said 40 years ago. Much of what he said about gender roles in 1980s has unfortunately either not changed or gotten worse.

- Factfulness: Ten reasons we are wrong about the world and why things are better than you think.By Anna Rosling Rönnlund, Hans Rosling, and Ola Rosling. I love this book’s title, and it’s true. Civilization has come a long way in the last 500 years when the Renaissance lighted and woken up the western world from the horrific Dark Ages, which held modern civilization back for a thousand years after the fall of the Roman Empire.

- Born a Crime by Trevor Noah. What a hyperactive kid and adult, and what a story growing up in apartheid South Africa. We saw his performance at Orange County Fair last summer with 8000 other screaming and laughing fans.

- Good Men Project, edited by Tom Matlack and James Houghton. Here is my Amazon review explaining why I only gave it 3 stars.

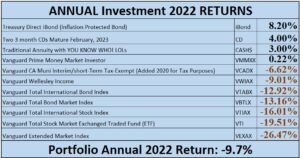

2022 Annual Portfolio Return: -9.7%

For the first time since 2008, my portfolio declined by almost 10.0%! Because inflation and interest rates rising caused the stock AND Bond Markets to decline. For the first time in its history, Vanguard’s Total Bond Market Index declined by 13.16%! Even famed 99-year-old Boglehead Forum legend, Taylor Larimore, was shocked and wrote a post on Bogleheads.org about it. He posted that the worst past year was 1994, when it declined by 2.9%. Here is Taylor’s post and discussion.

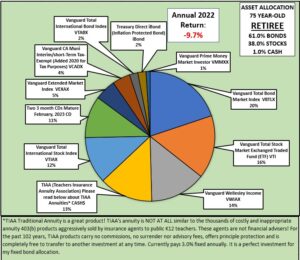

For the first time since the greatest financial disaster since the Great Depression of the 1930s, the stock market declined into nearly bear market territory, which is 20% down or more for the S&P 500. As I reported in my Q3 report on September 30, 2022, my portfolio suffered a bloodbath, declining 12.9%. But the Q4 offered a recovery of some sort with the final annual decline of -9.7%. More interesting information about my portfolio and how it relates to the overall stock and bond market is revealed in the table below–individual investment returns. Notice that four individual investment returns went positive! Inflation-protected bonds returned the most! Yet all we hear is the gloom and doom of how terrible the stock and bond markets were in 2022. A stock bond split and a diversified portfolio mitigate the negative hit because the stock market risk is lower than 100% stock investments. But in 2022, bonds were also negative in record territory. Bonds are supposed to be boring and steady, but not this past year when inflation hit hard, the highest since the early 1980s. So there are plenty of comparing to past declines events that have not happened for years. Mark Twain once wrote that history does not repeat itself but rhymes. He was a smart man who is quoted frequently a century after his death. But bonds appear to be the exception to Twain’s quote as they have reported the worse performance EVER! Read this article about bonds performance in 2022 from CNBC.

Because of inflation, we have higher interest rates, which, last I heard, are good. Once again, for years, money languished in Money Market accounts, savings accounts, and treasuries with the most pathetic returns that putting money in your mattress or buried in your backyard would make more sense. We forget the complaints of low-interest rates for our fixed accounts and now complain that high-interest rates made our otherwise solid performers within our stock/bond split, now are almost as disappointing as stocks.

Here is why I am Deliriously Happy!

But Steve, you may ask, “but 2022 was a terrible year for stocks and bonds.”

I agree, but folks, it is only ONE year!

AND

One Door Closes (temporally*), But Another Opens Up.

Investing takes many years to come to fruition, up to 20 years if you’re starting! I welcome higher interest rates. For the first time in my investing life, I added to my portfolio two Certificates of Deposit (CD) maturing in three months, paying 4.0%. Wow! I thought. I had to pinch myself to see if I was in dreamland. Both were available in my after-tax Vanguard Brokerage account. In the stock asset allocation, I added to my position in Vanguard’s Total International Stock Market and Extended Stock Market Indices. Below are graphs I got over my cell phone that show the drop in prices since before COVID hit. I drew those lines to show you that prices were at the same level before COVID and before the massive increase of stock during the time the feds were pouring money into the economy. The 2020 and 2021 stock market technology mania is gone, and the prices are back down to earth at levels not seen since the end of 2019. I thought now would be a good time to add to this position. Of course, I don’t know the future but what I did was add to my already diversified portfolio the extra cash I got from my house sale.

Vanguards International Stock Market Index

Vanguard Extended Market Index Fund

As I have been reporting since August 2021, when I sold a piece of property, I sat on cash for almost a year. I did not buy those stock or bond funds at historically high prices and waited and waited until the markets came down. But not only did stocks come down, but interest rates went up, so I made three moves with my house cash.

-

I bought more stock index funds at good prices (These are long-term investments. I’ll let you know in five or ten years, 🙂 ).

-

I bought two three-month CDs paying 4.0%.

-

I added to my Treasury Direct iBond, paying 7.2%

I am deliriously happy!

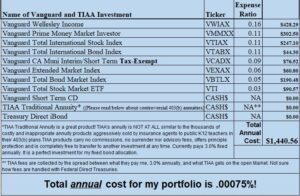

My expenses are the same because I have not changed my portfolio. After I set up my portfolio almost 20 years ago, I made some changes over the years but only according to my plan to keep costs low and to diversify to reduce risk. Notice I said to reduce risk, not eliminate it, which is impossible.

Please pardon the appearance of complexity in the pie chart below. While it looks complicated, it isn’t. I am just working towards diversity in the broadest stock and bond market possible. Look at the upper right corner for a bird’s eye view of my stock-bond split. That is the most important feature next to low costs to maintain the stock-bond split according to your diversification plan. If you are a young investor under 40 years old, your stock-bond split might be 80% stocks and 20% bonds, for example. But this is only a guideline. Don’t make any changes to your portfolio without your tax professional or financial adviser’s guidance.

Here is how to prepare your head, emotions, psychology, and temperament for negative and potentially scary stock market years like what we just had in 2022. It is late for any words of wisdom after 2022, but it doesn’t matter. Uncertainty in investing will always be around, and the more you think and read about it, the better you will be prepared to handle bad times. A well-thought-out diversification plan with low costs and the stock-bond split reflecting your age or need for money means nothing and will be abandoned quickly if we don’t have our head trained first. I believe this next piece will help.

Inspired by the Book Comfortable with Uncertainty by Buddhist Teacher Pema Chodron

Will emotions sabotage your well-thought-out, low-cost, diversified portfolio? Afraid of Making a Mistake? The Stock and Bond Market are not to Blame. So, what is?

The central question of your portfolio is not how to avoid stock market fear and uncertainty but how to relate to discomfort. In the do-it-yourself practice of managing our money rather than hiring an expensive financial adviser, how do we “hold on” despite our error-prone temperament brought on by the unpredictable and volatile markets? We know that embarrassment, disappointment, irritation, jealousy, and anxiety freeze us up. Such uncomfortable feelings are hidden messages that tell us to perk up and lean into a negative market when we rather panic (or get angry) and sell out and stay angry by never investing again.

We can catch ourselves before doing something stupid when the market bubble bursts, enters a correction, or into a full-blown crash. Don’t miss it by spinning our heads with self-inflicting knee-jerk responses. Enter the wise halls of intelligent investing by sticking with our well-thought-out plan no matter what. Get the hang of catching ourselves before we do something far worse to our plan and ourselves than the crash itself. Living through this subtle but powerful transition will bring a sense of peace, relief, and inspiration—confidence!

Admittedly, this is easier said than done. Books have been written about our behavior involving finances. Money and emotions run so deep that we are unaware of their impact on our decision-making. Our habits and patterns, many unconscious, pull us away at a moment’s notice. But with practice and investing experience by living through bear markets, we learn to relax amid money chaos. The market is an amazing and complex conglomerate of thousands of publicly traded companies worldwide, with millions of investors trading. Stock market pandemonium starts without any of our assistance. Uncertainty is built in the market, not us unless you allow it. Keep it at arm’s length by ignoring the hideous financial news distractions, and your emotions will follow. By accepting uncertainty 100%, we discover how to be separate and cool especially when the financial ground beneath us suddenly disappears. 2022 was one of those years that heaven and earth gave away. Just let it go. You and your low-cost indexed, diversified, and stock-bond split portfolio will work just fine.

Never forget that uncertainty is our companion that will help us through many of life’s hand grenades. The sudden death of a spouse/child/loved one, loss of employment/business, bankruptcy, disease, and relationship breakups are uncontrolled life experiences that are uncertain too. Have a cup of coffee with your newfound friend and plan accordingly before something terrible happens.

Happy New Year!

Best of fortunes for 2023, and may the market forces be kind to all of us,

Steve

*Over the last 200 years, according to the book Stocks for the Long Haul by Jeremy Siegel, the stock market has always increased over time. Of course, if an asteroid hits our planet, we are all doomed. But that is not going to happen any time soon. The stock market will recover; in fact, at this writing on January 12, 2023, the stock market has been positive, and my portfolio is up 2.6% YTD in 8 days of trading.

Steve’s Bio

*Stephen A. Schullo, Ph.D. (UCLA ’96) taught elementary students in the Los Angeles Unified School District (LAUSD) for 24 years, and UCLA Extension taught educational technology to student teachers. Because of his negative experience with annuity agents, unions, and his school district benefits personnel over the most horrific tax-deferred plan in history, the 403(b), Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) newspaper for 13 years.

So he became a 403(b) activist and talked to anybody who listened about reforming this terrible plan. He wanted to inform his colleagues that districts, the unions, and the insurance industry look out for their best interests, not teachers (For the record, I am a strong union supporter. I walked the line in 1989). The media began listening for the first time in the entire history of the 403(b) plan, commonly known as the TSA, in 1998. From 1961 to 1998, nobody in or out of education ever talked about this terrible 403(b), specifically with k-12 school districts. I kid you not!

Consequently, he thrice featured retirement plan advocate for reformed 403(b) plans for public k-12 colleagues in the Los Angeles Times and U.S. News and World Report. He co-founded an investor self-help group (403bAware with a colleague, Sandy Keaton) for teacher colleagues. He also wrote 7,000 helpful posts in three online investment forums since 1997. Frequently quoted by the media, testified at California State legislative hearings and was honored with the “Unsung Hero” award by United Teachers Los Angeles (UTLA) for his retirement planning advocacy.

For the last fifteen years, he has continued to serve on LAUSD’s Retirement Investment Advisory Committee (RIAC) as a “Member-at-Large” and former co-chair. The committee monitors the district’s 457b/403b of 55,000 former and current LAUSD employees, worth $3.2 billion in total assets. Lastly, Steve and his late husband, Dan, were featured participants for the award-winning documentary PBS Frontline: The Retirement Gamble, which aired on April 23, 2013.

Steve is the author of two books, “Fighting Powerful Interests: Educators Challenge Tax-sheltered Annuities and WIN!“, a story of how a handful of LAUSD educators struggled for years to improve the 403(b) to no avail. But we never quit! We were instrumental in LAUSD’s implementation of the new 457(b) plan and earned a very rare “Plan Design” award.

Steve is the co-author with his late husband Dan of a book on learning the investment process from the ground up, Late Bloomer Millionaires. It’s a heartfelt story about two ordinary chaps and how they discovered investing and money management without a professional financial adviser. They list all of their successes and massive mistakes, and they still retired earlier than most Americans.

For a copy of both books, email Steve at steve.schullo@latebloomerwealth.com, and he will happily email you both books, FREE, with no obligation except to read them and get informed, in a pdf file format.

Chris! Great to hear from you.

Congratulations to both of you on your retirements. Yep, that’s the spirit, giving back and you and Efren do that very well.

Your kind message is a blessing. Thank you so much.

Hugs to you and Efren,

Steve

Love this Steve. You continue to enlighten me across a broad spectrum of topics, while demonstrating that human growth is ageless.

Keep on living your best life, my friend!!!

Great to hear from you Nancy, and to have met you in person at the FI conference at Joshua Tree. All of those young people at that conference are probably millionaires or close to it by now! They get the investment process and they will live their best lives very soon as a result of financial literacy.

Best to you and your family in this new year,

Steve

Pingback: First in a Series: Passive Strategy Proposal for LAUSD 457(b) plan – Late Bloomer Wealth