Happy End of the First Quarter of 2023 Everybody! We all should be a least a little positive about the market performance in the first quarter, 2023. Yeah I know we are not out of the scary patch just yet.

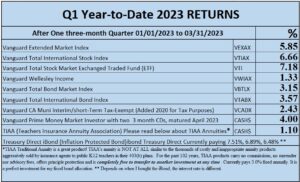

What can I say? The markets have struggled up and down for the past quarter and ended in the positive for all major benchmarks and my portfolio! My portfolio is constructed and designed to follow the markets and so my return for the first quarter of 2023 is up 3.2%. Yes, I know my positive return came from a terrible 2022 year where my portfolio lost almost 10.0%. So just to get back to the previous portfolio high over a year ago, my portfolio would have to return about 17% just to get even on January 1st, 2022.

Wonderful news any investor in my age group and retired. My CDs are paying 4.0%, my Treasury Direct iBonds are paying 6.5 to 7.5% and my TIAA Traditional Annuity will be paying over 4.0%!

For this report, I am going to cut to the chase so I can get this posted on my blog and send it out to you. I am very pleased with my entire portfolio as it is working the way I designed it to work, but there is another investment that I have not used in my entire investing life, Certificates of Deposit or CDs. I had some cash from the sale of my house and did not want to put the entire amount in stock indices so I took the opportunity to purchase two 3-month maturity CDs that both paid 4.0%. As I said I have never experienced those types of returns in such a safe investment before. Furthermore, I have a considerable amount of my old 403(b) in TIAA because I anticipated the raising of interest rates and the effect that would have on my Vanguard Total bond Market investment. So in 2016, I transferred about a third of that money from Vanguard’s Total Bond Market Index back into TIAA Traditional Annuity, which has paid 3.0% steadily since 2016. But even that Traditional Annuity interest rate has gone up to over 4.0%. In order to qualify for the higher interest rate account, I had to transfer my money to TIAA’s MM fund and wait four months and put it back into the Traditional Annuity to start earning the increased rate. In the table of returns, TIAA paid a paltry 1.1%. That’s because the MM interest rate is 1.1%. But when I transfer it back to the Traditional Annuity I will start earning in excess of 4.0% or whatever the rate will be. The four-month waiting period is to discourage excessive trading. I totally agree and don’t get me started on trading. I hate trading because I choose the broadest low-cost index funds and keep them forever! I am the ultimate buy and hold and I have had this portfolio for 15 years during my entire retirement.

This year I will be retired for 15 years from LAUSD, as a retired teacher. I love retirement as I can do what I want when I want it and never look back. I never taught again because when I retired I knew what I wanted to do and that is write my books. Frankly, I did not know much about blogs or blogging 15 years ago, but my book shepherd turned me on to blogging.

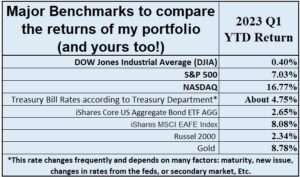

Everybody’s portfolio should have a comparable benchmark to make sure your portfolio and mine are on track. The easiest way to examine if your portfolio is off track is to compare it with the major benchmarks listed in the following table. Warning, if your portfolio lost money during this last quarter SOMETHING IS TERRIBLY WRONG!

All the major benchmarks went up. If your portfolio is designed similarly to mine, no worries because your portfolio will increase too (see the pie chart below).

My Portfolio Individual Investment Returns

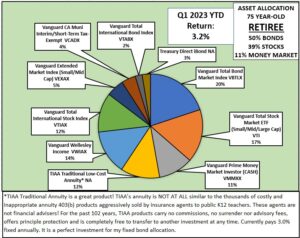

My Asset Allocation.

My allocation is best for somebody deep into retirement, for my age and willingness to take risks. I am at the protection and distribution stage. If you are much young and still working, you should be taking more stock indices risk more 40% of your portfolio. But before you take on that kind of risk for any age, talk to your financial professional or tax profession first. I am not a financial adviser! I just share what I do as a 75-year-old retired investor.

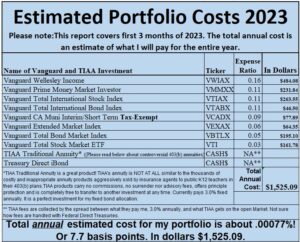

Costs

Not enough can be said of keeping costs low. People do not realize how a minimal cost of 1.0% has a devastating effect on building wealth over time. My total cost is less than 1/10 of 1.0% and I love it as more money stays where I want it, in my pocket, not some broker’s yacht.

That’s it for the first Quarter of 2023. Look for my 2nd quarter report in July 2023.

Steve’s Bio

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and UCLA Extension teaching educational technology to student teachers.

Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) union newspaper for 13 years. Thrice featured retirement plan advocate in the Los Angeles Times and U.S. News and World Report. He co-founded an investor self-help group 403bAware for teacher colleagues and wrote 7,500 posts in three investment forums since 1997. Frequently quoted by the media, he testified at California State legislative hearings and was honored with the “Unsung Hero” award by UTLA for his retirement planning advocacy.

For the last seventeen years, he serves as a volunteer on LAUSD’s Investment Advisory Committee as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s tax-deferred retirement plans, 457b/403b, of 55,000 former and current LAUSD employees, worth $3.1 billion in total assets.

He started this blog in 2012 to help all PreK-12 public school educators nationwide, especially his Los Angeles Unified School District colleagues. He belongs to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b). During the last 25 years, over 40 newspaper articles have been published and each one says the same thing, TSAs (Tax Sheltered Annuities) are terrible 403(b) plans. Over and over again, the articles report that the salesperson gets the benefit from lucrative commissions and high costs. Nobody in educational leadership reads these articles NOR talks about the proper place for annuity products publically. We come together at 403bwise.org. Come on over if you want to join us so we can help our colleagues avoid these self-conflicted retirement plans, TSAs.

For a copy of both books, click on my home page and scroll down to the two books. Click on each book and download it FREE. No obligations as I am not a financial adviser.

Email Steve at steve.schullo@latebloomerwealth.com or ask your question after each post.

Pingback: How Does Irony Explain the 403(b)/TSA “Safe” Money “Guarantees”? – Late Bloomer Wealth