Hi LAUSD Colleagues. Welcome back to my blog.

Exciting News!

Below is my open letter to my colleagues on the Retirement Investment Advisory Committee (RIAC). But before I get to my letter, I want to introduce why I wrote the letter.

I am so excited because our advisory committee (Retirement Investment Advisory Committee, RIAC) is currently in discussion to improve and update the Award Winning 457(b) plan! It’s been over a decade since the last time we made portfolio changes, and a lot of good things have happened. It is time RIAC takes advantage, updates our plan, and perhaps earn additional awards. While the current plan is a great plan, there is always room for improvement. Our colleagues deserve an improved volunteer tax-deferred retirement plan so that more teachers, administrators, and support personnel will enroll, start saving, secure their financial retirement future, and perhaps retire earlier than expected. That’s been my experience! But you have to plan ahead, and that means now.

I am only one member of RIAC, but I want to share my humble “A Modest Proposal” for simplifying the current lineup of investments by reducing duplication, lowering the total number of choices at even lower costs with broader diversification with an all-indexed lineup of investments.

Enjoy my letter!

Steve Schullo, Retired LAUSD teacher, blogger, and author of two free books. See the detailed bio at the end of this post.

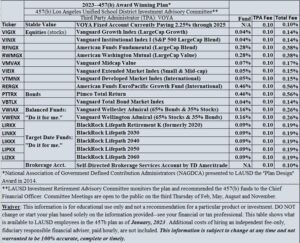

Our Award-Winning* Current Plan

Average Cost: .19%

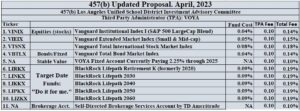

A Modest Proposal: Isn’t it Elegant?

Average Cost: .16%

Dear RIAC Colleagues,

This letter gives me great pleasure to share with you. Allow me to begin with a question that my spouse Georgiana suggested, as she is a savvy investor, smarter than me. Question: Which of the two costs would you want to spend for investment fees, A. $190.00 or B. $160.00 per $100,000 nest egg per year? The answer should be a no-brainer! I would prefer $160.00 (more about this difference later). But first, my entire letter is about reducing costs and complexity by consolidating some investments, as you can see in my Modest Proposal above.

Below are the five talking points we could focus on when we meet on April 20. As we know, the RIAC has done great work for 17 years, and the primary reason was always to look after our participants’ best financial interests. But the exciting part is that most participants need to learn that their nonprofessional collective bargaining rep colleagues with a ton of plain and ordinary common sense are advising the CFO. The collective bargaining reps and the retired members are volunteers. Along with our professional financial consultant, benefits administration, the Board of Education rep, and the CFO rep, we advise the CFO, David Hart, who makes the final decision.

I have always taken great pride in my contribution to RIAC since the beginning during the hot summer of 2006 at LAUSD headquarters. After all these years, I am still honored to be asked to serve on RIAC by formal legal counsel David Holmquist. Before RIAC, I wrote investment articles in the UTLA newspaper every year for 13 years. Sandy and I organized a self-help group called 403(b)aware and scheduled informal meetings at a restaurant for five years. In those days, nobody helped our colleagues learn about the low-cost, non-annuity options on the 403(b). Also, along the way, Sam Kresner, former assistant to the UTLA President, asked me to attend the AFT national 403(b) selection committee meeting to select a new 403(b) vendor. I testified in Sacramento twice to update the industry-backed and decades-old Insurance Code that had a stranglehold on a monopoly position forcing California districts to keep quiet and let the insurance agents run amok selling their expensive annuities with pathetic returns. Both measures failed, but CalSTRS 403(b)compare.com was a tiny compromise against the powerful insurance lobby.

I wrote a free book Fighting Powerful Interests, published in 2015, that details my story (and many other educators) of getting sold a high-priced annuity and wondering why the public school districts have done very little. After five decades of doing nothing, LAUSD did something revolutionary, led by the forward-thinking and avuncular, now retired George Tischler, benefits launched the new 457(b) plan with non-annuity and genuine investments with mutual funds. But benefits administration weren’t done just yet. They did the unthinkable in the history of tax-deferred retirement plans with PreK-12 districts. They formed an advisory committee with collective bargaining units as reps! Wow! Sometimes I pinch myself to realize that this unique situation is scarce in the PreK-12 world, but it’s real.

When I landed on the RIAC committee, I already had a ton of experience. Seventeen years later, I bring to this committee not just a revamped 457(b) proposal but, following the legendary Mr. Tischler’s example, something more. Between the lines of this upcoming discussion about costs, active vs. passive, reducing the selection, eliminating duplication, etc., I hope that what I am trying to convey is not just a revamped portfolio. My revamped proposal is designed to last forever with a lot less attention. RIAC will not need to monitor the investments as much as in the past.

RIAC can begin discussing a new way forward—paying attention to the people we are serving. How about instead of listening to the same reports repeatedly, how about discussing the needs and thinking of the 9000 already enrolled and especially the remaining employees who are stuck in high-priced 403(b) products and, finally, the biggest challenge of all, getting the 70% of LAUSD employees not enrolled to enroll. Let’s discuss how we can support what Leonard and Sandy did by organizing more educational workshops at UTLA headquarters and asking the remaining unions to sign up for auto-enrollment. It is never on the agenda, and when it is, we don’t have the time to discuss it.

“A Modest Proposal.” Only about 30% of LAUSD employees are enrolled in either 403(b) or 457(b) or both, but that dismal statistic is nationwide. As mentioned, roughly 9,000 LAUSD employees are invested in 457(b). That number exceeds most of the nation’s PreK-12 district employees and students combined. So, it is a big deal.

For years the RIAChas faithfully advised the Chief Financial Officer of the 457(b) plan and a monitoring system that is in our colleagues’ best financial interests. Our update and revamping could stimulate more interest and participation for the 70% not enrolled.

I think when we:

- Reduce Complexity

- Reduce Costs

- Reduce volatility

- Change to an all-index strategy.

- Increase diversification

- And reduce the number of investments from 19 to 11

we are advancing best practices, and the enrollment and selection process for colleagues to understand, and whatever choices of investment they decide will be just fine.

For the committee’s future advisory role, the need for investment monitoring will be reduced because the new portfolio we submit to the CFO is so basic it should last far into the future. The current portfolio has lasted over a decade. With the improvement of the current plan by this proposal, there may not need to be a change for decades. The asset allocation would be settled so that we can focus our efforts on education and enrolling. As I said at the beginning, RIAC’s future is about getting to know our participants’ needs through education more than anything else we do. This is exciting.

Professionals and laypeople have debated and discussed the above points for years when investing in the stock and bond markets. The time has come to look at our current lineup of 19 choices and come up with a revamp and update to our Award Winning 457(b) plan. I will explain what I am thinking when I make this proclamation: Our participants can make good choices without thinking that participants made a mistake. There is nothing wrong with a modest proposal.

Reduce Complexity: We have duplicating stock assets when all that is needed is Vanguard’s Institutional Index with its low cost of .04%. Vanguard Growth Index, American Funds Fundamental, and American Washington Mutual are unnecessary repeats. Why offer all large-cap funds? Getting rid of these three funds is a no-brainer, as two have been on the “watch list” for more than three quarters.

Having separate Growth and Value Styles makes no sense because the Vanguard Institutional Index has both styles. Trying to explain to our colleagues the pros and cons of growth or value style may seem like we are giving them the best of both worlds. But I fear that it complicates the decision-making and forces them to second-guess their choice. What if Value underperforms and Growth takes off or conversely? Vanguard’s Institutional Index I removes that needless effort to decide.

Reduce Costs: The cost of our current line is lower than the industry standards for a straightforward reason—the consumers are on the committee. Despite our vociferous objections, in 2006 our first consultant ramrodded the hideous revenue-sharing costs down our throats. With our colorful history of this committee relentlessly lowering costs since the beginning of RIAC, we should never rest on our laurels. There is plenty of room to lower costs more, and this proposal does exactly that.

Ten years ago, 50 basis points were acceptable, but not anymore. Even the mutual fund industry has lowered costs by huge margins! In the last decade, the industry has reduced costs so much that Fidelity has released zero fees on some index funds because they were desperate to compete with Blackrock and Vanguard. And VOYA will reduce their TPA expenses again to 9 basis points when assets exceed $350 million. What are we waiting for? Let’s follow suit and reduce our costs.

NFP Retirement, Barbara, reports that our average is 19 basis points, but the averages are misleading. I calculated that my proposal would reduce costs to a spectacular 16 basis points on average (In addition, I calculated these .19% and .16% on $100,000 to ask that question at the beginning of this post). I never liked averages because they leave out important information that the committee and our participants who invest in the expensive funds need. For example, we have two funds that are 56 basis points and two funds that charge 28 basis points (total fees including VOYA’s ten basis points). Some of our participants are paying costs that are three times the cost of the average that the committee gets on every report. BTW, our committee has also been relentless about informing the participants of the total costs, both the Third Party Administrator, VOYA (AKA record keeper), and the investments themselves.

Reduce volatility. Of all the rationales, reducing volatility is something we all could agree on. But it might be the most complex to explain. But what exactly are we trying to do, and why would that be helpful to our participants?

Understanding how the financial industry does business makes it more evident. The industry makes money by trading and trading frequently. Frequent trading increases volatility. Average investors in most 401(k), 403(b), and 457(b) plans make money by investing in diversified core equity (stocks) asset classes and balanced out by fixed accounts and sticking with them over a lifetime. What does “sticking with a plan” or “investing for the long haul” mean? It means only trade to rebalance a portfolio or make retirement distributions. Excessive trades are not needed and are against best practices.

Furthermore, we investors want to trade less than the profession. Because the differences between the industry incentives and most average investors’ incentives are staggering. This difference is discussed next.

Industry Incentive is making money over a minute, I repeat, tiny, piece of every trade. It sounds like little money, but traders do this 24/7, whether stocks or bonds, worldwide. Interestingly, the competition among the traders is staggering, but no Wall Street big bank, brokerage firm, or individual trader has an advantage. All went to the same Ivy League schools or University of Chicago, Stanford, MIT, or Caltech in Pasadena, and earned the same or similar MBAs, same statistical/math training, same trading skills training, and similar experience working with a team of experts or working alone. To think that an average investor with a spreadsheet and an outdated laptop working alone in their home office can compete with the smartest people the world has ever created with all their massive resources is next to insanity. Powerful high-speed trading technology would even make Warren Buffett pause.

Average Investor’s Incentive. What can the average inductor do under these circumstances? Don’t play the trading game; never listen to the financial news media, bottom line—don’t trade. After Jack Bogle’s first index fund was launched in 1976, most financial industry grudgingly gave us an out. Indexing and the passive strategy are universally accepted because investors are flocking to Vanguard and Blackrock with billions of assets, running from active management to index funds.

Our incentive is to increase wealth over a lifetime of gradually saving and investing while working and accumulating. Keep focused on our personal goals. We know that it is not a get-rich scheme. Indexing reduces volatility significantly. We have two 457(b) funds to compare Pimco’s Total Return (bond fund) and Vanguard’s Total Bond Market Index. According to Morningstar, Pimco trades about 289% each year! 289% is a clear example of excessive trading–the total assets are traded almost three times over! Vanguard’s Total Bond trades 40% a year. No other fund in our 457(b) exceeds 60% turnover each year. The industry wants to trade, and ordinary investors want to stick to a plan.

Again, another piece of data confirms that people don’t want all that trading let alone the fees that Pimco charges. Why does Vanguard’s Total Bond have $91 billion in assets, and Pimco has only $55 billion? Could it be that Vanguard outperforms Pimco? Or does Vanguard have lower costs? Does all this trading produce better returns? These questions will be discussed next.

Change to an all-index strategy.

The debate on passive/active strategies has been settled years ago after intensive debate. SPIVA (S&P Index Vs. Active) has answered this question for 20 years. They have studied domestic, international, growth, value, small, mid, and large-cap asset classes. Morningstar and Vanguard employed different methodologies and resulted in the same results. Rick Ferri, the author of “The Power of Passive Investing” in 2010, revealed that the portfolio of index investments vs. a portfolio of active investments was even more devastating for active management.

Warren Buffett’s famous bet. The one-million-dollar bet was issued to challenge any hedge fund mucky muck that the S&P 500 can outperform their hedge fund. After nine years, Buffett won the bet by a MASSIVE margin. The bet wasn’t even close. The Vanguard’s S&P 500 index fund’s cumulative returns were 85%, and the hedge fund 22%. Can you believe it! Some of the smartest people in the country manage Hedge funds. Their costs are unbelievable, 2% assets under management plus up to 20% of profits (and Assets Under Management AUM of up to 2.0%). Yeah, you read that right. Investors expect that skill from very smart hedge fund managers will pay for the fees. In Buffett’s case, all that intelligence, skill, and stock market knowledge did not outperform a boring buy-and-hold S&P 500 index that costs a minuscule .04%.

All this information and SPIVA, Morningstar, and Vanguard profoundly answered the question: Can a mutual fund active manager outperform their appropriate benchmarks? The answer is yes. But they don’t outperform by very much and not for very long.

It is beyond this essay to elaborate on why active management underperforms the indices. But I will mention one precise predictor of future returns, costs. As Buffett’s famous bet illustrated, the index is a fraction of the cost of active managers. The second reason is more philosophical and plain common sense. Nobody can predict the future, especially which company stock will outperform the averages year after year. There are way too many unpredictable moving parts and an occasional shocking event called Black Swans (9/11 and the pandemic). But even the stock market is wholly unpredictable. Yet the persistence to think it is by too many regular investors is astonishing.

Furthermore, a good company may have lousy stock, and a bad company may have the opposite. Every prospectus I read says this repeatedly: “Past returns are no guarantee of future returns.” I hope I made this point loud and clear.

Increase Diversification.

This is a simple fix. Our current lineup is close to offering 100% diversification of the core assets. The US domestic stocks are fully covered, but we only need emerging markets in the international stock fund. The “developed countries” are not enough for 100% diversification. Most Total International Stock Indexes offered by investment companies have developed and emerging markets, whether Fidelity or Vanguard. Vanguard and Fidelity have 70% of their Total International Stock Market Index in developed markets and 30% in emerging markets for those concerned about increasing risk with emerging markets. About risk, all stocks (and bonds) have risk, and one way of managing risk is to diversify. Volatility is reduced but never eliminated. Vanguard’s index fund has about 7900 international stocks, and Fidelity has about 5500.

My proposed portfolio includes the entire planet’s publicly traded stocks. These are large, mid, and small-cap international stocks (ex-US). Additional stocks are not included because they don’t fit the capitalization requirement. In other words, they are too small, and their stocks are worth less than $101 million in capitalization (To qualify for inclusion in the small-cap Russell 2000, a company must have a range of $101 million to $2.61 billion in asset capitalization).

The current portfolio has a good beginning for the passive strategy with stocks and bonds. My proposal finishes the job by deselecting the non-indexed investments and adding either Vanguard or Fidelity’s Total International Stock Market Index (Institutional). The portfolio mix of stocks, bonds, and cash is complete by retaining Vanguard’s Total Bond Market Index and VOYA’s fixed account. The participants will have a minimum number of choices to help them achieve their financial goals for a comfortable retirement only dreamed of in the 403(b) world. Remember, “less is more” will be discussed in detail next.

Reduced the Number of Choices from 19 to 11.

I hope the entire committee, consultant, and CFO agree that 19 choices are too many. There are many valid reasons to reduce this number without losing diversification, as already discussed.

Wellington and Wellesley. Some of you mentioned that you are adamant about retaining Vanguard Wellington and Vanguard Wellesley. I realize I will get pushback. I am not trying to “change anybody’s mind.” Good grief, good luck with that! However, just listening to my rationale and how these fit in with achieving all we want to accomplish in this portfolio update, we could do better with a number less than 13.

If they are retained, it would bring the total number of choices to 13, which is not enough of a decrease in the number to make a difference.

- First, Wellington and Wellesley are actively managed. You have already read that active management fails to outperform the averages.

- Second, Blackrock Target Date funds are duplicated enough to replace Wellington and Wellesley. Wellington and Wellesley are “do it for me” balanced funds too, so they are not needed. The entire series of Blackrock funds are already balanced between stocks and bonds. The bond allocation is already covered with either YOYA fixed or Vanguard Total Bond Market Index. Wellington/Wellesley stock allocations are large-cap value. Making an additional unnecessary choice only to invest in one style over another makes the decision more difficult and complex.

- Third, by comparing their fees to Blackrock’s nine basis points, Wellington and Wellesley are expensive, almost twice as expensive at 16 basis points. Participants who want Wellington and Wellesley can buy them in the brokerage open window account.

- The final point is essential. We want to make the core asset classes available in stocks and bonds. For stocks, it is easier to do this with large, mid, and small-cap domestic and international stocks. But for bonds, it is more complex because there are so many different types of bonds, TIPS, iBonds, short, intermediate, and long-term treasuries, and short, intermediate, and long-term corporates, not to mention the same duration with international bond markets. Each state has tax-free municipal bonds for taxable accounts. The total Bond Market covers Treasures, Mortgage-backed and corporate bonds. Bonds are not stocks. They offset stock index losses and keep the portfolio balanced, especially in the preservation stage, usually for retirees. VOYA fixed account, Vanguard’s Total Bond Market Index and Blackrock’s Target Date fund series offer plenty enough of bond exposure. If any participant wants additional bonds, they can always go to the brokerage account.

With eleven choices, no genuine fiduciary financial adviser worth their weight would say that it is a mistake to invest in any one or a basket of the ten choices (The brokerage account is an entirely different animal beyond my rationale. I wonder what investments those 92 participants chose!).

There are no unique, strange, or speculative investment options here. NONE!

These ten investments are core assets and nothing more. They belong in every portfolio, including our LAUSD participants. Pensions, endowments, and foundations have these assets. Every institution globally has Apple, Microsoft, Tupperware, government and corporate bonds, and cash. Any choices beyond these core asset classes, such as Wellington and Wellesley, complicate the decision and do not answer the crucial question that many investors fear, “I don’t want to make a mistake.”

Active management aficionados can speculate with their “play money” in the brokerage account. Nothing in Modest Proposal prevents anybody from investing what they want if it complies with the IRS requirements for tax deferment.

Based on the latest available data from our consultant’s report (December 31, 2022), VOYA’s fixed account and Vanguards Institution Index (S&P 500) have the most assets. Due to the asset size of these two investments, our colleagues are telling us they like these choices.

Summary. There you have it, colleagues. My proposal aligns with ERISA 404(c) diversification requirements with the three-fund requirement minimum, our state fiduciary mandates that we should practice prudence in selecting and advising the CFO, and our IPS. The time to revamp and upgrade our portfolio is now. It is long overdue, given the massive changes in our favor from the financial industry.

*Our 457(b) plan won a Plan Design Award in 2014 from the NAGDCA, National Association of Governmental Defined Contribution Administrators.

Steve’s Bio

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and UCLA Extension teaching educational technology to student teachers.

Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) union newspaper for 13 years. Thrice featured retirement plan advocate in the Los Angeles Times and U.S. News and World Report. He co-founded an investor self-help group 403bAware for teacher colleagues and wrote 7,500 posts in three investment forums since 1997. Frequently quoted by the media, he testified at California State legislative hearings and was honored with the “Unsung Hero” award by UTLA for his retirement planning advocacy.

For the last seventeen years, he serves as a volunteer on LAUSD’s Retirement Investment Advisory Committee RIAC as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s tax-deferred retirement plans, 457b/403b, of 55,000 former and current LAUSD employees, worth $3.1 billion in total assets.

He started this blog in 2012 to help all PreK-12 public school educators nationwide, especially his Los Angeles Unified School District colleagues. He belongs to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b). During the last 25 years, over 40 newspaper articles have been published, and each one says the same thing, TSAs (Tax Sheltered Annuities) are terrible 403(b) plans. Over and over again, the articles report that the salesperson gets the benefit from lucrative commissions and high costs. Nobody in educational leadership reads these articles NOR talks about the proper place for annuity products publically. We come together at 403bwise.org. Come on over if you want to join us so we can help our colleagues avoid these self-conflicted retirement plans, TSAs.

For a copy of both books, click on my home page and scroll down to the two books. Click on each book and download it FREE. No obligations as I am not a financial adviser.

Email Steve at steve.schullo@latebloomerwealth.com or ask your question after each post.

Steve,

You have hit a 4-bagger once again.

It is past time for USLAD employees to stage a parade in your honor.

Cheers,

Ted Leber

Hi Steve,

As an LAUSD teacher, “Boglehead” investor and 457b/403b advocate among my colleagues, I fully support your modest proposal. Reducing duplicative funds and focusing on a “3 fund portfolio” option or target date option makes a lot of sense. Keeping investment options low cost and simple to understand is the best way to encourage more teachers to participate.

Thank you Ted! You have been a fighter for better 403(b) plans for decades. Thanks for your support and all of those years trying to change the system. It’s lonely out here!

Regards,

Steve

Hi Josh, fellow Boglehead investor. I learned it all on Boglehead’s forum years ago to KIS!

Your post here is much appreciated!!!!

This Thursday, the ad-hock investment committee will meet to discuss the update of the 457(b) portfolio. The committee has a long history of keeping costs low. We now need to keep it simple.

Thanks for your comment!

have a great day,

Steve

Pingback: Steve’s LAUSD’s 457(b) “Modest Proposal” Update! – Late Bloomer Wealth

Pingback: Year-to-Date Half Way Mark 2023 Portfolio Report by Steve – Late Bloomer Wealth