Before you scroll down to my tables that reflect 2023 portfolio return as a whole, needless to say, 2023 turned out to be an outstanding stock and bond year! Everything went up! But the year started slow for three quarters and finished in the 4th quarter with nine straight weeks of gains for all five of the major markets, DOW, S&P 500, International, Bonds and the NASDAQ:

-

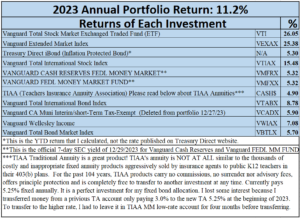

- Quarter 1 Portfolio Return: 3.2% YTD after three months

- Quarter 2 Portfolio Return: 5.9% YTD after six months

- Quarter 3 Portfolio Return: 3.8% YTD after nine months

-

2023 Annual Return: 11.2%!

Let’s compare my portfolio returns to the five broad Stock and Bond market averages:

- Dow Jones Industrial Average (DOW): 13.7%

- S&P 500: 24.23%

- NASDAQ (Technology Stocks): 43.42%

- iShares MSCI EAFE Index (International): 18.40%

- Bloomberg Aggregate Bond (Bond Benchmark): 5.77%

The above data show that my portfolio is performing exactly as designed. Higher than bond returns and lower than stock returns. So, the combination of stocks and bonds (38% stocks and 62% bonds) performed in between the two. The situation has been called the Goldilocks return: not hot or cold, just right for my primary goal of preservation of capital as I am well into retirement and need this money to support my retirement activities.

After the devastating 2022 stock and bond market year, when both stocks and bonds declined and my annual return for 2022 was a -9.7% return, I saw a 3.2% gain in my portfolio in the first quarter of 2023 (Click for my 2022 portfolio report). What happened? Inflation has been the story all year as it continued to go down after the first quarter report, and it is the primary reason I got an 11.2% return for the entire 2023 year!

Inflation Declined

When inflation declines, the bond market traders predict that the Federal Reserve Bank will follow suit and lower interest rates (they have not). In the meantime, the value of my bonds increased. This explains why all my bonds had an incredible year, too. My Vanguard Total International Bond Index returned 8.78%! All of my bonds returned more than 5%! I have avoided long-term bonds because they are the most volatile. All of my bonds are intermediate-term bonds, which are more resistant to interest rate changes but still can help keep pace with inflation.

What was the primary reason the markets soared during November and December 2023? Inflation decreased steadily for the last six months of 2023. When that happens, the secondary bond market reduces interest rates that fell below 4.0% for the first time in 2 years. All my bond values went up, resulting in a fantastic performance for ALL OF MY BONDS! When bonds fall below 4.0%, investors feel like returning to stocks. This combination of events triggered a change reaction as the market traders priced in the simple fact that the Feds, who are in charge of interest rates, will begin to reduce them starting in March 2024.

Of course, no one knows if the Fed will reduce rates. But that crucial omission didn’t matter. It is one of the most powerful human temptations, the perception/anticipation/expectation that they will! Investors, especially active investors (I AM NOT!) who really believe they control the markets and the traders, want to get in on the action early. How hilarious, feeble, delusional, and stupid is that?! That’s all it took for this perfect storm to actualize, resulting in a rip-roaring bull market for the last two months of 2023 and a whopping 11.2% annual return for little ole me and my portfolio! I just road along with the crowd and did NOTHING!

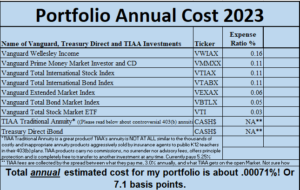

Here are the amazing returns,

my asset allocation,

and the total cost.

The next paragraph links to one of my favorite authors who wrote The 12 Lessons Learned in 2023. This article is not about which stocks or funds performed the most or the least in 2023, nor does it forecast what might happen in 2024. Larry did a wonderful job reminding investors that the quantitative data produced by anybody, including mine, is about past returns and offers NO LESSON or WISDOM about the future. Investors cannot control or predict what will do well with accuracy. However, my asset allocation and the low fees are what I pay attention to because I can control how I mix my investments between stocks and bonds, choosing the lowest cost indexes. Larry talks about what to do and think about after you construct your plan that you can live with, through thick or thin.

12 Lessons the Market Taught Investors in 2023 by Larry Swedroe

All of the lessons Larry discusses are available to everyone who is financially literate, even teens. If you are not now financially literate but you are reading this, you will eventually be financially literate. Speaking of teens, almost half of the states require one semester of financial literacy for middle and high school students. Surveys show that almost all adults would have loved a class on finances in high school and greatly support these efforts now. Many adults recognize this as important to their children’s lives but may not feel confident enough to teach it to their children. That is where a huge shout-out must go to another of my heroes, Tim Ranzetta, cofounder of Next Gen Personal Finance (NGPF.org), for organizing this effort and his decade-long effort to train teachers to teach financial literacy, the new progressive advocacy.

This is Our 2023 Holiday Message

2023 was a year of the family. 2023 was sharing love with those we love. An amazing year! Beginning with a San Diego birthday party with friends from Bali. A beautiful wedding in Wisconsin and visiting Stephen’s clan in Cumberland, La Crosse, Chippewa Falls, and Minneapolis, MI. East Coast living for two months, rain! with two flooded basements, hurricanes in Cambridge and Palm Springs, a PINK concert at the historic Fenway Park in Boston, Cape Cod, and back home to the fabulous Hollywood Bowl with John Legend. We had cataract surgeries, so we’re really seeing those bright Christmas lights. We also both had skin cancer, the kind that surgery treats. We’re fine now. Some advice, get checked, wear sunscreen and hats. Stephen continues his financial volunteer work with LAUSD and returns to his hard work days as he tills and plants in the Long Beach community garden. Georgiana took a sabbatical to write a memoir. Slow but sure. Continuing to write prayers for a small prayer book. She became a producer/supporter for her Goddaughter’s new songs. With a new vision, we look forward to the bright, happy love of revisiting some of you! Invite us. We’ll arrive. The years get richer in knowing what’s important, and that’s you all.

I found additional odds and ends to report with more detail about the wonderful year 2023 offered.

La Crosse, Wisconsin, the city, and lacrosse, the ancient North American game. Georgiana met my Wisconsin family in one fell swoop at my grand niece’s wedding. The wedding location was in La Crosse. After the wedding, we stayed in La Crosse to explore this huge resort area where the huge St. Crois River merges into the mighty Mississippi. Then we stayed at three other places where my relatives welcomed us at their farms. Chippewa Falls, WI, with another grand-niece and her family. Cumberland, WI, with my nephew and his wife on their huge farming business of 1000 milking cows, was next (I grew up on the farm my nephew now owns), and finally, to Minneapolis to visit yet another grand-niece, her husband, and three children.

La Crosse is named after the oldest organized game in North America, dating back to the 12th century, created by the indigenous people. Those games were like our modern games, with organized competition among many tribes lasting centuries.

LAUSD’s Retirement Investment Advisory Committee (RIAC): My Experience and business trip to Seattle, WA. One of my longest-running volunteer commitments is my committee membership with my old employer’s LAUSD retirement supplemental plan (RIAC). Along with a committee colleague, Sandy, we went to this financial conference to continue our education about employer-sponsored tax-deferred volunteer retirement plans (401(k), 457(b), and 403(b)). It’s a massive conference with hundreds of financial professionals who consult and record keeping for non-profit employers nationwide. Like most conferences, I met colleagues from all over the country, which I had not seen since before the pandemic. I followed up with two people who will help me make the 403(b) plan at my former school district more fee-transparent. 403(b)s with public k12 school districts are notoriously expensive, and their fees are often hidden. Why? Because aggressive insurance agents purposely push expensive products to exploit trusting and naive teachers.

For an entire story about these plans, download my free book, Fighting Powerful Interests. It is my story of discovering this terrible plan and what my friends and I did to fix it. My book is for my colleagues, public K12 teachers, and support staff.

2023 Weirdest Experience

The venue was a local theater, the Long Beach Playhouse, offering a classic Agatha Christy play performed by local talents. It was a Christmas gift from Georgiana’s California family. The play went uneventfully as planned, and the acting was good. Then the shit hit the fan!

During the performance, I heard some bantering behind me. I didn’t give it much thought until the most bizarre event escalated! After the intermission, the theater manager came on stage and repeated the mandate of wearing a mask because the performers were maskless. She then pointed out this guy behind me in the area where others and I had heard a commotion earlier. She startlingly announced that the second half would not start until one person wore a mask. The audience shouted at this delusional radical individualist to put a mask on.

The situation escalated quickly when this idiot said he would wear a mask if everyone were quiet. How quaint and childish, but people like him complain that we do not respect them! When this individual attempted to walk on the stage, the manager ran up and yelled, ” you cannot walk on the stage! A struggle ensued with four or five guys with the idiot on the floor!

This all happened within perhaps 2 minutes, and I was sitting there wondering, is this happening? OMG, but I was never afraid. Four squad cars arrived with four police officers on hand. The four of us decided to leave, as who knows what this guy might do next. As far as I know, the play continued and finished.

Health

I mentioned that my portfolio and the stock market started slow, so did our health. We are fine. But I went through a bought of skin cancer. Yeah! Can you believe it? I am Italian with brown eyes. How could I contract skin cancer? “Easy,” my dermatologist said. “Most skin cancer starts with the first sunburn before 18 years old,” he said. I remember working without a shirt on the hot Wisconsin days on my family’s farm, and I did get sunburned once or twice, but it was never severe. The cancer mole was removed successfully, and so I have survived my 2nd cancer.

At the end of 2023, I had my annual physical and blood test. I found out I have some plaque buildup in my aorta around my heart. My cardiologist said the low level of plaque is nothing to worry about because most men my age have some plaque, and my blood tests for cholesterol over the years have been normal.

Finally, here are the books I read in 2023, about one a month. I am a slow reader but write in a journal every morning.

1. Born a Crime by Treva Noah. Treva came out of the shoot ready to be what he is so famous for today: comedian, preacher, lecturer, news show host, and so accomplished in many ways. He was preaching at his church at five years old. I kid you not! A must-read is Growing Up in apartheid South Africa. He was literally born a crime because his mother married a white man, and mixed-race Blacks could be arrested and sent to prison, and this was in the 1980s!

2. The Good Men Project: Real Stories from the Front Lines of Modern Manhood. Edited by Tom Matlack, James Houghton, and Larry Bean. An updated version of this rare topic from the 1980s Iron John, a massive bestseller by Robert Bly. I was always interested in the ever-changing role of American men, and this book attempted to explain how men have adapted. I am still curious about how our society is coping, and many of the problems have not changed 40 years since Iron John was published. Here is my review on Amazon: Click here.

3. Narrative Economics: How Stories Go Viral and Drive Major Economic Events by Robert Shiller. Shiller provided many primarily financial newspaper stories over the decades, highlighting how anxious human beings turned many smaller stories into something bigger.

4. Flash Boys by Michael Lewis (read twice. It’s so good!). If you are interested in how the professionals work at the biggest mucky-muck brokerage houses and banks, read this book on how 34 brave individuals tried to change some of the greed culture everywhere on Wall Street. Here is my review on Amazon: Click here.

5. Tyranny, INC By Sohrab Ahmari. This book is scary. He informs and educates readers that private equity and hedge funds are not our friends. Many of us already knew this, but I got a wake-up call on just how motivated these people are to make a buck while hurting some of the most powerless and vulnerable people on the planet: private prisons, assisted living facilities, people without health insurance, and many other businesses. Private equity is just that private. They don’t have to report anything to anybody! That makes them unpredictable, coercive, and a public danger to the most vulnerable.

6. Fooled by Randomness by one of my favorite authors, Nissan Nucleus Taleb. I believe this is Taleb’s first book, and he is writing a lot of rambling or just a stream of consciousness. As I write this, it occurs to me that is what he is trying to explain in his writing and his thoughts. There is no past and no future. What we have is now. Many Buddhist books and philosophers have taught this, but Taleb explains that we are fooled by journalists and scientists, especially in finance, to think that the past and the future are not random. Journalists and the media, by all accounts, only sell what sells, which is short-term sensationalism and especially negative.

7. The Black Swan: Second Edition: The Impact of the Highly Improbable by Taleb, Nassim Nicholas. This is the author’s most famous book, discussed everywhere in online financial forums. The status quo from Wall Street minimizes the huge financial risks such as 9/11 and the Pandemic have on our financial portfolios and the financial system. Furthermore, the business schools, media, and Wall Street talking heads continue to preach that these surprises are rare. However, the author disagrees, and he has a compelling message that I agree with because I like to create my portfolio to withstand the unpredictable. People want to believe these huge events rarely occur. The author reported that they happened more frequently than the formal data says, and the methodology needs to be updated. When they do, they minimize their negative effect on our portfolios and our worldwide civilization.

8. The Behavioral Investor by Daniel Crosby. This book is terrible. But I recommend reading it! I read it because it’s another rare book discussing the significant role our psychology and emotions play in financial decision-making. Sometimes, a book that offers 100% bad advice is a great strategy to learn the difference between sales pitches and objective financial information. This book is a slick 100% sales pitch, so I recommend reading it. It’s about psychology, but the psychology explained in this book is to convince you that you can think like the big boys and girls and beat the market averages.

Crosby goes to great lengths to show you how to pick those winning 20 to 30 stocks and beat the market year after year. Then, the author details how to do this by cheering on all successful active managers IN THE PAST to convince you that you can do this, too. What absolute rubbish. Further, he has the totalitarian gall not to share how his portfolio performed (he could publish his returns without jeopardizing his privacy) nor what stocks he currently owns. Wow! Such audacity and thinking nobody will notice?! This book is so bad but worth reading because you will learn how the author plays with your emotions; yes, it’s the reader’s emotion on the line here. Don’t fall for this terrible advice!

9. Super Cannes: The Novel. I read novels, too, but the Tyranny, INC author recommended this one. It ended with the protagonist planning on finishing the job that the primary killer started when he killed ten people. So, it wasn’t a murder mystery at all. It was about the motivation of the leading psychiatrist who died while trying to stop the insanity of this company, which existed for the sole purpose of taking advantage of people for power and profit. The massive dysfunction doesn’t even describe a valueless and self-serving corporation. Suppose you watched the Max series “Succession, ” a spoof of Fox News Corporation. In that case, the story reflects a similar culture of politics, family, entitlement, unethical behavior, and all the characters’ unhealthy mix of mass media.

Steve’s BIO and Personal Finance Story

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) from 1984 to 2008, and UCLA Extension taught educational technology to student teachers.

A Brief History of the Horrific 403(b) with Public K12 School Districts

When I was a young teacher, I started saving for retirement. I bought two Tax Sheltered Annuities. We educators immediately recognize the brand name TSAs. Later, when I learned that annuities were not an appropriate plan for building a long-term retirement nest egg, I discovered mutual funds were available. The first question I asked was, “Why didn’t anybody in the district tell me this?” Worse yet, they refused when I asked the district benefit administrator for a printed list of available low-cost mutual funds (called no-load) on the 403(b) list! (The 403(b) is the IRS tax code for tax-deferred retirement plans for government workers. It is the equivalent of the private sector 401(k) plan).

I felt I was being treated like a 6th grader, admonished for asking impertinent questions. I had to write the names of each mutual fund on my own paper. And then, I had to research to find out which ones cost the least. The benefits clerk said it was against district policy to provide a list. Furthermore, she did not know which ones were no-loads. Zero help!

What was wrong with this picture? I wanted to invest 100% of my money in one of the lower-cost investments that was already approved! Instead, the district treated me like a barnyard parasite for asking. Had I been treated with respect, my book, Fighting Powerful Interests, would have never needed to be written.

We already have a Pension!

Public School K12 teachers do not need a “guarantee never to lose money in the stock market.” That’s what pensions do. I also discovered that my union only had high-cost plans on the “Union Approved” list which was terminated in 2008. Thank Goodness! I wanted to stop this self-conflicted 403(b) system of our union members getting sold high-cost and non-investment products.

Throughout the business of economics and investing, every financial planner, adviser or other financial expert I talked to said that annuities had high costs with pathetically low returns. An annuity is an insurance product that is wholly inappropriate for building a nest egg because of its high costs and caps on returns. What was insane is that nobody was talking about this in any public way. UTLA had a retirement committee that I attended for years and their focus was on CalSTRS, our pension plan.

I started writing letters to the board of education and benefits personnel asking questions. I also explained the situation to the UTLA union newspaper editor, who accepted and published my articles. Thus, for the next 12 years, from 1996 to 2008, I wrote about the 403(b) low cost alternatives for the United Teacher-Los Angeles (UTLA) union newspaper. Many union members responded positively (the annuity sales people were not happy).

I also got lucky when I reached out to the mainstream print media. Over the years, many mainstream media reporters quoted me about my experience with the sad state of 403(b) plans, including the Los Angeles Times, NY Times, and U.S. News and World Report. Because of the Los Angeles Times article, I found twenty-five LAUSD colleagues who had the same concerns and wanted to do something. With two colleagues, we co-founded an investor self-help group called 403bAware for teacher colleagues.

To change state law that protected insurance salespeople rather than teachers, I testified at California State legislative hearings. I eventually was recognized and honored with the “Unsung Hero” award by my teachers’ union for my retirement planning advocacy.

My Second Life—Retirement and My Commitment to the LAUSD Advisory Committee!

For the past 14 years, I have served as a volunteer on LAUSD’s Investment Advisory Committee as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s new tax-deferred retirement plans, 457(b).

Enter the New 457(b) Plan!

When the 457(b) was launched in January 2007, it began to reflect my image of low-cost genuine investments, just what my colleagues and I were asking for. No annuities. Over the years we swapped out the higher-cost mutual funds for lower-cost index funds from Vanguard and Blackrock. As a result, LAUSD won a rare Plan Design Award in 2014 from the National Association of Government Defined Contribution Administrators (NAGDCA). As of June 2020, 11,000 LAUSD employees with about $200 million in combined assets are invested in the 457(b). And it continues to grow.

The 60-year-old 403(b) plan has $2.8 billion in assets with about 55,000 LAUSD current and former employees. When the enrollment decreases, the annuity sales force continues to sell its high-cost plans to our LAUSD colleagues. While the district has a policy for prohibiting on-site presentations of 403(b) products or meeting with teachers on the school property or during professional development workshops, they often openly violate his policy. The free lunches are too much of a temptation for district professional development coordinators, office managers and school site principals to resist. They think they are doing a good thing for teachers, BUT THEY ARE NOT!

Eighty percent of the 2.8 billion of those assets are in high-cost annuity products or high-cost mutual funds with expensive advisory fees. Two low-cost plans are available on the 403(b), CalSTRS Pension2, and the giant pension TIAA, familiar to higher education faculty.

Why I started this Blog

I started this blog in 2012 to help all PreK-12 public school educators nationwide, especially my Los Angeles Unified School District colleagues. I belong to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b) and support the new and lower cost 457(b) plan.

During the past 25 years, 40 newspaper 403(b) related articles have been published. Each one says the same: TSAs (Tax Sheltered Annuities) are terrible 403(b) plans. The only one who benefits is the salesperson with lucrative commissions and high-costs and other benefits such as complimentary trips to Tahiti, Hawaii, and other exotic places. Nobody in educational leadership or many teachers read these articles. And we don’t know why….

Action Plan: Our Advocacy is Growing

The following links are to get my free books and to get more information about stopping, getting out or transferring a high-cost plan to a low-cost plan.

It is also for those advocates who want to help colleagues with their 403(b)s. If you are helping yourself get straightened out of the annuity product and into a genuine and lower cost investment, we are here to help with resources so you can help your colleagues too.

We come together at 403bwise.com and 403bwise.org on Facebook https://www.facebook.com/groups/349968819000560/ Come on over if you want to join us so we can help our colleagues avoid these self-conflicted and high-cost Tax-sheltered Annuities (TSAs).

I was so angry that I was taken advantage of that I authored of two books, Late Bloomer Millionaires and Fighting Powerful Interests: Educators Challenge Tax-sheltered Annuities and WIN!, a story of how a handful of LAUSD educators struggled for years to improve the 403(b). Fighting Powerful Interests is specifically written for LAUSD teachers! This book expands on my story with LAUSD, UTLA, and AFT where I was on the selection committee in 2002 when AFT was selecting a national 403(b) vendor. It is all there and its fascinating. You will learn the business of tax-deferred retirement plans with LAUSD and how to become a savvy investor to grow your volunteer supplemental retirement plan.

I have learned that most people want to do the right thing for all LAUSD employees, but powerful obstacles own interests block reform. Find out what they are by reading Fighting Powerful Interests, so together we can fix the 403(b) for future generations of teachers.

One definite answer to the high cost 403(b) is the non-biased and low-cost 457(b) plan. You will learn firsthand what is the 457(b) plan and why one insightful and compassionate benefits administrator brought it to LAUSD. He also asked my friends and I to serve on the volunteer advisory committee.

My LAUSD friends and I never quit! As mentioned before, we were instrumental in LAUSD’s implementation of the new 457(b) plan and earned an exceedingly rare, but very precious “Plan Design” award.

For a FREE copy of both books, email me at steve.schullo@latebloomerwealth.com and I will happily email you both books, FREE with no obligation except to read them and get informed, in a pdf file format.

During retirement I did what most people do when retired: Travel.

- Three times to Africa

- Twice to South America, Peru, Mucho Picchu

- Chile

- Argentina

- Cuba

- Twice to Vietnam, once as a Marine to Vietnam in 1968, and once as a civilian in 2018.

- Portugal in 2012 Paris in 2019.

- Cambodia and Laos in 2018.

- Mexico’s Copper Canyon.

- Traveled around the country in a RV

- Morrocco

- Paris

- Cape Cod and New England

Pingback: Steve’s Q1 2024 Investment Portfolio Report – Late Bloomer Wealth