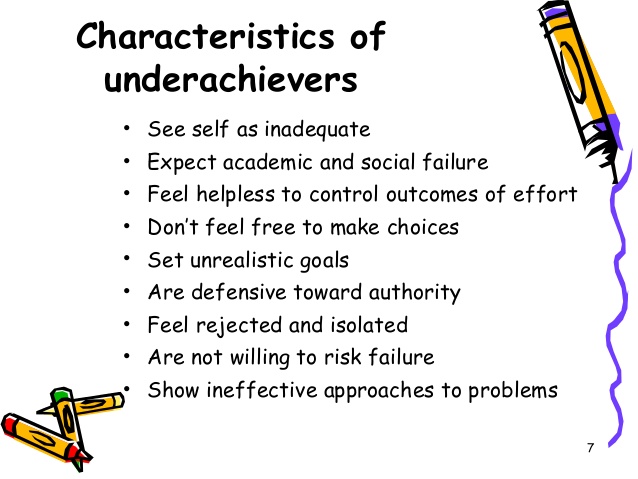

I am a proud underachiever and late bloomer. However, it was not like that in my youth and young adulthood. It took years of painful growth, earning three college degrees after age 30, learning from financial mistakes, and my Buddhist spiritual practice to get to this positive status. Here is my academic underachiever list:

- missed Kindergarten: My neighborhood one-room country school did not offer it

- flunked 2nd grade

- barely graduating from high school with deplorable grades (I thought I was retarded because of my 2nd-grade failure)

- painfully shy in school throughout my childhood and young adult, socially inadequate

- zero natural talents in every subject: art, athletics, speaking, music, math, writing, 97 IQ, reading, and comprehending.

- zero confidence in anything

Additional Challenges

- My father had chronic health problems, illiterate, emotionally and intellectually absent who died what I was 13

- Tolerating my older brother’s belligerency, verbal abusive diatribes brought on by his bipolar schizophrenia

- Got fired, laid off, or rejected from jobs due to few skills or no natural talent

Of the many success and self-help books that I read, and my psychology degrees, I discovered the age-old wisdom of turning your so-called personal deficiencies into strengths.

How I Confronted the Fact that I was a Second Grade “Funky” was SHOCKING and Wonderful!

When I finally graduated from college at 30 years old, I was on the Dean’s list because of superior grades and started rubbing elbows with my first academic and scientific star by listening to Buckminster Fuller’s speech at the Dean’s List Award banquet. It is something to be proud of because I still gained much of the positive, life-changing wisdom of life and education and later on in my life. What was the most surprising turnaround is that when I started my teaching career, I started with the very grade that I flunked–2nd grade.

This was never planned as I became a teacher only because I needed a job, not because I was in love with the profession (I discovered later that it was an honorable profession that I was truly grateful that I choose and taught for 24 more years until I retired).

I would have never thought that I would be managing a seven-figure portfolio without an expensive professional adviser. It may have taken me longer, but I earned financial independence sooner than most in my boomer generation, retiring from teaching when I just turned 61.

For me, underconfidence and underachieving possess advantages especially in building wealth and frugal living. The common rule of thumb is that the smarter or intelligent one is more advantageous a person has because others want to be around him or her and they have more opportunities as their gifts and talents are wanted a needed by others. But in personal finance, you do not need a certificate, business degree, or intelligence. In fact, confidence who often leads to overconfidence in investing can backfire with dire consequences. I have read enough books and have heard it from people even a teacher or two who all said that learning to invest successfully is not that complicated, and that being less confident in your abilities is a strength, not an obstacle!

For anybody who has never read one book on personal finance, just picking up and reading a book on basic investing, you would be 1000 miles ahead of most Americans who do not have a clue. I agree that you might not be ready to manage on your own, but from then on you cannot turn back as you will build on the basics gleamed from the one book.

“it ruined my drinking career” How One Alcoholic Speaker Chimes In

This concept reminds me of an Alcoholics Anonymous speaker who went to AA for a short time and “slipped” meaning he started drinking again and left the program. He eventually came back by proclaiming that AA “ruined his drinking career forever!” He said every time he sat at a bar drinking and glanced at the bar clock reading 8:30 PM, he knew AA meetings were starting somewhere. He could not get that lifesaving image out of his mind no matter how hard he tried and how much he drank. Fortunately, he read his mind correctly and went back to AA. He became a featured speaker because of his unique story and most of all stayed sober and lived to tell about it.

After reading one of the 3 books below and thinking that you got nothing out of it, the next time you watch the stock markets news on TV or on social media some basic investing media clips may not be so foreign. Then like the AA member, you will want to read another personal finance book. As the power of compounding interest, compounding learning has powerful and profitable “interest” too.

Just plowing through one of the following books you will experience, as I did with all of my prior personal and academic deficiencies, makes personal finance and investing not at all scary, foreign, and intimidating any longer.

My Recommended Books for Beginners

- Teach and Retire Rich by Dan Otter (My review on Amazon)

- The Simple Path to Wealth by CL Collins (My review on Amazon)

- Late Bloomer Millionaires by Steve Schullo and Dan Robertson (Free download. Just click on the book on the home page).

Steve’s Bio

Stephen A. Schullo, Ph.D. (UCLA ’96) taught in the Los Angeles Unified School District (LAUSD) for 24 years and UCLA Extension teaching educational technology to student teachers. Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) union newspaper for 13 years. He has been featured and quoted in many mainstream media articles about 403(b) plans, including the Los Angeles Times, NY Times, and U.S. News and World Report. He co-founded an investor self-help group 403bAware for teacher colleagues and wrote 7,500 posts in three investment forums since 1997. He testified at California State legislative hearings and honored with the “Unsung Hero” award by his teacher’s union for his retirement planning advocacy.

For the last 15 years, he serves as a volunteer on LAUSD’s Investment Advisory Committee as a “Member-at-Large” and former co-chair. The committee contains collective bargaining reps from the unions and monitors the district’s tax-deferred retirement plans, 457b/403b, of 55,000 former and current LAUSD employees, worth $2.8 billion in total assets.

He started this blog in 2012 to help all PreK-12 public school educators nationwide, especially his Los Angeles Unified School District colleagues. He belongs to a small national group of 403(b) advocates (mostly teachers) who want to bring closer attention to the 403(b). During the last 25 years, 40 newspaper articles have been published and each one says the same thing, TSAs (Tax Sheltered Annuities) are terrible 403(b) plans and the salesperson gets the benefit from lucrative commissions and high-costs. Nobody in educational leadership reads these articles NOR talk about the proper place for annuity products publically. We come together at 403bwise.com and 403bwise Facebook page https://www.facebook.com/groups/349968819000560/ Come on over if you want to join us so we can help our colleagues avoid these self-conflicted and high-cost Tax-sheltered Annuities (TSAs).

Steve is the author of two books, Late Bloomer Millionaires and Fighting Powerful Interests: Educators Challenge Tax-sheltered Annuities and WIN!, a story of how a handful of LAUSD educators struggled for years to improve the 403(b) to no avail. But we never quit! We were instrumental in LAUSD’s implementation of the new 457(b) plan and earned a very rare, but very precious “Plan Design” award.

For a copy of both books, email Steve at steve.schullo@latebloomerwealth.com and he will happily email you both books, FREE with no obligation except to read them and get informed, in a pdf file format.