Hi Family, friends, colleagues, and readers,

This is a long half-year report as I combine my travels, books I read, cancer diagnosis and recovery, and my volunteer work on the Los Angeles Unified School District Advisory Committee (Click here and scroll down to the Retirement Investment Advisory Committee, RIAC link) with how my portfolio has performed year-to-date to fund it all. I hope you enjoy what people do after the working for money career (retirement) besides writing blog posts and volunteering on Los Angeles Unified School District’s advisory committee.

In my last quarterly report for January, February, and March 2023, my portfolio gained 3.5%. I was happy! But for the next three months and the halfway point, as of June 30th, my portfolio gained 5.9%!

Now I am delirious! Please feel free to skip what I did with my lovely Georgiana to the end of this blog post to look at the details of my portfolio’s performance for the first six months of 2023.

Skin Cancer

In the first quarter, I had a positive skin cancer report on my lower back, which was removed. Thank goodness skin cancer is the most easily treated IF CAUGHT EARLY. Like the stock and bond markets, life has a way of always surprising us in unpredictable ways.

Just keep an eye on any mole; the one that got cancer was sore and red and looked different. That’s all it took for me to get it checked out, and sure enough, it was basil cell carcinoma. Had it surgically removed with a 95% chance of full recovery, and I will get it rechecked in a year.

Our 3rd Wedding Anniversary Dinner in Palm Springs and a Trip to San Diego

The legendary Frank and Val showed up as usual, and we got a reservation at Trios Restaurant in Palm Springs to celebrate our third year together.

Frank and Val, friends since the 1970s, were the first friends I took Georgiana to meet. I loved them and wanted them to know I would be OK.

After the death of my 40-year spouse two years previous. They assured me that Georgiana was THE ONE! I already knew Georgiana was the one, but it is always good to hear from friends too. We celebrated our third anniversary with Frank and Val and renewed our vows with cake and lots of love.

Our Test Tube Flower Pot!

The next day after our 3rd-anniversary celebration, we drove to San Diego to celebrate one of Georgiana’s lifelong friend’s birthday, Andre. We dined in Little Italy. We had our dessert at the best desert-focused restaurant in San Diego.

Georgiana always comes up with funny outfits and bought these silly sunglasses to wear just for this picture. She loves to live it up for any occasion. I love her much!

Andre had a great birthday celebration. I had never seen Torrey Pines State Park or San Diego’s Little Italy.

Andre had a great birthday celebration. I had never seen Torrey Pines State Park or San Diego’s Little Italy.

Books I read in 2023

James Baldwin and Richard Rodriquez

I have insomnia sometimes, and I read during the quiet night when I wake up.

I reread Richard Rodriquez’s first book, the Hunger of Memory: The Education of Richard Rodriquez.

I read his work trying to get insights into my own experience as a first-generation Italian American with uneducated immigrant parents and my struggles growing up with a single mom and a mentally abusive and belligerent older brother who was mentally disturbed. My dad died when I was 13, but he was sick for several years before, and my mom had to bring home the bacon to support us. I grew up without a father, which affected me my entire life, but that’s another story. The Mexican American immigrant experiences in Rodriquez’s books are different from my experience. However, as a literary giant, I liked how he wove the vast difference college did for him as an educated man, and neither his parents nor mine about me, also an educated person, could ever understand.

James Baldwin: The Fire Next Time

I never read James Baldwin’s. I found The Fire Next Time on Georgiana’s books shelf during one of my insomnia nights. I liked the book so much that I read it twice. His style is a stream of consciousness with bits of nuggets such as gold miners’ experiences.

Baldwin’s writings about American race relations America were profound and spot-on from an African-American perspective in 1963. Unfortunately, while race relations have improved, the book is still accurate in 2023.

Investing Book Reviews

I started 2023 by finishing a long book by the famous Yale Professor Robert Shiller, Narrative Economics. He examined the effects of how humans react to booms and busts from newspaper accounts during the last 100 years. We all agree that money issues bring out the worse or the best in humans! I thought it was an interesting book, but I wonder if I would recommend it.

Since my blog is about financial literacy, the most engaging book I read recently is from an unknown author, at least strange to me until he was interviewed for the Bogleheads podcast by Rick Ferri–Daniel Crosby. I was enthralled by Crosby’s background in counseling and psychology as I was in my early days before I went into teaching. So he wrote several books about finances as he changed his career to be a financial consultant. His most memorable book was “The Behavioral Investor.” I wrote a lengthy critical review and posted it on Amazon and my blog.

My review is not only a review of Behavioral Investor but a reflection of my entire investing philosophy with my background in psychology too. My review explains why I have a boring, low-cost, employing the passive strategy with a broadly diversified stock and bond portfolio.

The Bible, the Gedion International Version

In many conversations with his disciples, Jesus was sometimes frustrated as his disciples could not believe all the miracles he performed. Jesus would sometime get angry at his disciples as they had so little faith that he was the son of God.

Please, I am no expert just because I am reading the Bible for the first time. I am amazed at the subtle pearls of wisdom for living and the ancient style of writing.

Wisconsin Wedding Invitation

My grand-niece, Allison Schullo, invited Georgiana and me to her outdoor wedding in a gorgeous remote pasture in rural Wisconsin near La Crosse. We were looking forward to our trip to Wisconsin and Minneapolis, Minnesota, to visit my relatives. We were excited since we got the invitation in November last year!

Instead of describing our midwestern travels, I have posted the following pictures.

Bride and Groom. My goodness, the Groom is Tall! Allison is my nephew Joel’s daughter. Like her parents and older sister, Allison is a high school math teacher. Her husband is a plumber.

More grandnieces and great grand nieces!

After the wedding, we stayed at different relatives’ homes on our ten-day journey of Wisconsin and Minneapolis. I gave Georgiana a tour of my hometown Cumberland Wisconsin. I took her to the farmhouse I was raised, which is located about 7 miles outside of town.

The house was built about the turn of the last century (1900) and owned by another family.

My grandparents on my father’s side bought this house and the farm buildings in 1903. Both died ten years before I was born in the 1930s.

My nephew Dan, a great-grandson of Aliseo and Maria Schullo pictured above, and Dan’s wife Pam own the property.

Los Angeles Unified School District (LAUSD) and Retirement Investment Advisory Committee (RIAC) Development

Another exciting activity I have been involved with for 17 years is volunteering for an advisory committee. We advise the Chief Financial Officer of the Los Angeles Unified School District about the district’s three volunteer retirement plans, the ancient, out-of-date, and very high-cost 403(b), the low-cost Award Winning 457(b) plan, and the PARS program. We meet every three months or quarterly to review the investments and advise the CFO if any changes should be made.

- Click here to read my “Modest Proposal” for a needed update on the investments in the 457(b) plan.

- Click here for an Open Letter to my fellow RIAC members about my “Modest Proposal.”

My Efforts to add Vanguard to the Los Angeles Unified School District’s 403(b) plan

We also review the 403(b) plan. For 30 years, I have tried to get LAUSD to add Vanguard to the 403(b). I became more knowledgeable and sophisticated about my approach about three years ago. I got unintentional help from LAUSD benefits when the last RIAC Chair retired, and a new chair was much more open to my request! Plus, the committee realized that something should be done to improve the plan by adding another low-cost vendor (CalSTRS Pension 2 and TIAA are the only low-cost vendors).

Blackrock and Vanguard are the most famous low-cost vendors on the 457(b) plan. I got my motion to add Vanguard on the 403(b) side passed unanimously and sent to the CFO for his final decision. The CFO said there was no procedure to add or subtract a vendor, so benefits, legal, and financial consultants to our committee, and the record keepers are assisting at this writing to create a procedure. Click here for my blog post about adding Vanguard.

4th of July “What Are You Fighting For?

My friend and 403(b) warrior, Scott Dauenhower, wrote about financial freedom in his weekly blog post. At any halfway point of any year, we are about to celebrate our country’s declaration of independence on July 4th. He asked an interesting question by making it personal: “What are you fighting for?” I love those inquiries as the answer will be more unique and genuine instead of a stamped-out cliche: He is referring to financial freedom as our country fought to be free from the English empire.

Did you know that when the Continental Congress passed the resolution and publically read the “Declaration of Independence,” many powerful British warships patrolled the harbor surrounding New York City? It took eight long years, and we won with extraordinary military assistance from the French! Please think of the odds that this country, with its ragtag tiny army, beat the mighty Redcoats.

In my FREE downloadable pdf book, Fighting Powerful Interests, my friends and I at Los Angeles Unified School District fought for twelve years to get a low-cost tax-deferred retirement plan to replace the insurance industry empire-type plan, the forever monopolized by powerful insurance companies and their annuity agents’ 403(b). Like our country, with assistance from the French during our historical revolution, in 2006, our small band of warriors got a surprise announcement! LAUSD administration launched the 457(b) plan to offer a low-cost plan with genuine stock and bond investments that grow with the economy to compete against the high-cost 403(b).

But the story doesn’t end with the LAUSD. Unfortunately, the insurance industry still monopolizes most districts’ 403(b) and 457(b) plans. We will continue the fight for decent tax-deferred retirement plans throughout the country. Most teachers seeking help on the popular 403bwise.org Facebook page are getting out of an annuity and into Vanguard or Fidelity. Annuities are still being sold to any teacher, administrator, or support personnel by the boatloads. At LAUSD, yeah, we have the low-cost 457(b) plan with 375 million in assets sounds great. Still, over 3.0 billion, that’s right, three BILLION dollars and GROWING, are sitting in high-cost 403(b) annuities earning next to nothing.

My blog continues the fight to get an entire public educational culture to reform the 403(b) into a powerful benefit plan equal to our other benefits (pension, health, vision, and dental). My friend Scott asked an important question. Let’s answer it by becoming financially literate.

My Portfolio’s Half-Way through 2023 as of June 30

Fighting back means getting out of a bad 403(b) and into a low-cost investment. But it is a little more involved than just cost alone. One answer to my PreK-12 colleagues caught in the monopoly of TSA annuities is to look at my fully diversified portfolio, the costs, and how it relates to the broad stock and bond markets. The goal is to construct a simple retirement plan that grows with the broad economies and stop wasting money on prehensible insurance contracts known as very expensive and low-performing annuities.

Here is my halfway 2023 portfolio report. Four times a year, I report my portfolio’s performance, asset allocation, very low costs, and my stock/bond split. It is to provide you with my portfolio numbers and compare them to the broad market returns. I have constructed a portfolio that follows the market. My portfolio will go up when the market goes up like it has this past six months.

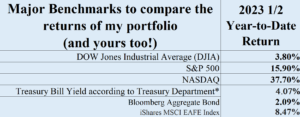

First, let’s start with the benchmark YTD returns. These are the returns that the domestic and world stock and bond markets did for the first six months of 2023. Did you notice that EVERYTHING went up? How cool is that? Did you also see that Treasury bonds yield 4.0% or more? I am so thrilled that, finally, retirees have a decent return on good old fashion bonds and money market accounts!

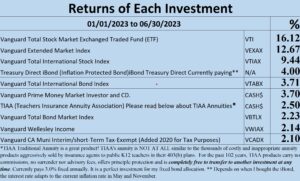

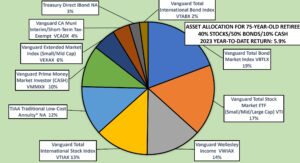

And did it go up? Wow! I captured a 5.9% return, and I am deliriously happy! But Steve, some of you might question. “Your portfolio only went up 5.9%, and the first investment, the total stock market index, went up 16.12%. Why so low at 5.9%?” Having 100% in one investment core asset is NOT diversification. Because I need my investments now for retirement living and constructed my portfolio to be less risky. The stock-bond split is about 40% stocks / 60% fixed, bonds, and cash. I deliberately created my portfolio to follow the market, whether it goes up or down, but not as high in returns in a bull market and, at the same time, not as low a return in a bear market.

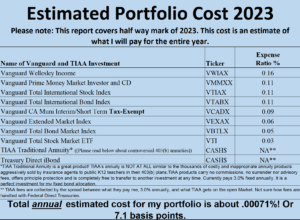

Costs: Vanguard shows the cost of each one of its index funds. To calculate how much you are paying for each investment multiple the cost with the proceeds in each fund. That will result in a dollar figure.

I have discovered that costs in percentages don’t mean much, but a dollar figure has a direct impact! If I were charged 1.0% in costs of a typical financial adviser, my cost for the year would be outrageous! For example, if you or I had $100,000 in a portfolio, paying 1.0% for hiring an advisor to manage our portfolio, it would cost about $1000 a year for $100,000 (1.0 X 100000).

This is where it gets interesting. For that same $100,000 and paying seven basis points in fees, the total dollar cost would be $71.00. The insulting question is, what would you rather pay

- A. $1000.00 every year in fees (100,000 x .10) or

- B. $71.00? (.00071 x $100,000)

A thousand dollars is way too much money for a manager who will do little to improve my portfolio. Let’s not try and create the “perfect” portfolio because it doesn’t exist without much buying and selling, resulting in high trading costs and taxes! I must have a common sense portfolio that fits my needs as a long-retired educator for the past 15 years and counting.

My pie chart below, with all its colors, makes the usual impersonal and ugly picture of a diversifying portfolio BEAUTIFUL! My portfolio is not as simple as JL Collin’s two-fund portfolio he discusses at length in his famous worldwide book: The Simple Path to Wealth. My portfolio has different types of bonds and bond funds, and I have included an International Index Fund by Vanguard. Collins would have nothing of it. But he had and still has an important message, keep your portfolio simple, and it’s more likely that you will stick to your plan.

What an exciting quarter! Georgiana and I are currently in Cambridge, MA, visiting her family. We will end our trip here with a stay on Cape Cod and its wonderful-looking beaches. But I will not swim as the water is way too cold for this southern California swimmer.

Have a wonderful summer.

Best of fortunes everybody!

Steve

Steve’s Bio

*Stephen A. Schullo, Ph.D. (UCLA ’96) taught elementary students and educational technology to teachers and students in the Los Angeles Unified School District (LAUSD) for 24 years, and UCLA Extension taught educational technology to student teachers. Because of his negative experience with annuity agents, unions, and his school district benefits personnel over the most horrific tax-deferred plan in history, the 403(b), Steve wrote investment articles for the United Teacher-Los Angeles (UTLA) newspaper for 13 years.

So he became a 403(b) activist and talked to anybody who listened about reforming this terrible plan. He simply wanted to inform his colleagues that districts and the insurance industry are looking out for their best interests, not teachers. The media began listening for the first time in the entire history of the 403(b) plan, commonly known as the TSA, in 1998. From 1961 to 1998, nobody in or out of education ever talked about this terrible 403(b), specifically with k-12 school districts. I kid you not!

Consequently, he thrice featured retirement plan advocate for reformed 403(b) plans for public k-12 colleagues in the Los Angeles Times and U.S. News and World Report. He co-founded an investor self-help group (403bAware with a colleague, Sandy Keaton) for teacher colleagues. He also wrote 7,000 helpful posts in three online investment forums since 1997. Frequently quoted by the media, testified at California State legislative hearings and was honored with the “Unsung Hero” award by United Teachers Los Angeles (UTLA) for his retirement planning advocacy.

For the last fifteen years, he continues to serve on LAUSD’s Retirement Investment Advisory Committee (RIAC) as a “Member-at-Large” and former co-chair. The committee monitors the district’s 457b/403b of 55,000 former and current LAUSD employees, worth $3.2 billion in total assets. Lastly, Steve and his late husband, Dan, were featured participants for the award-winning documentary PBS Frontline: The Retirement Gamble, which aired on April 23, 2013.

Steve is the author of two books, “Fighting Powerful Interests: Educators Challenge Tax-sheltered Annuities and WIN!“, a story of how a handful of LAUSD educators struggled for years to improve the 403(b) to no avail. But we never quit! We were instrumental in LAUSD’s implementation of the new 457(b) plan and earned a rare “Plan Design” award.

Steve is the co-author with his late husband Dan of a book on learning the investment process from the ground up, Late Bloomer Millionaires. It’s a heartfelt story about two ordinary chaps and how they discovered investing and money management without a professional financial adviser. They list all of their successes and massive mistakes, and they still retired earlier than most Americans.

For a copy of both books, email Steve at steve.schullo@latebloomerwealth.com, and he will happily email you both books, FREE, with no obligation except to read them and get informed, in a pdf file format. Or just find the home page here and scroll down to the books and download them yourself. They are an easy read and my story. Enjoy!

Hi Steve, I just love it when you post your gains, losses, and life experiences. I am a LA native, but have rural Wi roots. Thankfully I was able to see and experience all of Wi natural beauty and see my grandmothers farm brief it was torn down a few years ago.

Is there a way I can e mail you directly? I am a lausd employee = ) Thank you!

Thanks!

My email is

steve.schullo@latebloomerwealth.com

Thank you!

My apologies for the horrendous typos in my previous post. Feel free to edit it.